Time to acknowledge China’s economic power.

The statistical evidence clearly shows that China is the world’s number one economy. Unfortunately, the US and many commentators are unwilling to acknowledge that reality, but future stability depends on acceptance that we are living in a multipolar world.

How big is China’s economy today compared to America’s?

Despite the regular descriptions of China as “the second biggest economy in the world”, the statistical evidence shows that is just not true. If properly measured the Chinese economy is already the biggest in the world.

The problem is that most international comparisons of economic welfare and economic capacity are based on national estimates of GDP adjusted to a common currency – usually the US dollar – using the current exchange rate. But exchange rates are affected by a host of other factors, and do not correspond closely to the differences in price levels between countries.

Instead, as all statisticians know, international comparisons of the size of GDP should be based upon purchasing power parities (PPPs). These PPPs are the price relatives that show the ratio of the price in national currencies for the same good or service in different countries.

The aggregate PPP which is used to compare different countries GDP and GDP per capita is then a weighted average of all the individual PPPs for the different goods and services produced. As such the aggregate PPP represents the rate of currency conversion that exactly equalises the purchasing power of different currencies by eliminating the differences in price levels between countries.

For example, a basket of goods and services that costs $100 in America costs only about $60 in China. This means that Chinese goods and services are much cheaper than their American equivalents adjusted by the exchange rate. It also means that the US dollar is seriously overvalued and that its use exaggerates the value of US production and consequently the size of the US GDP relative to other countries.

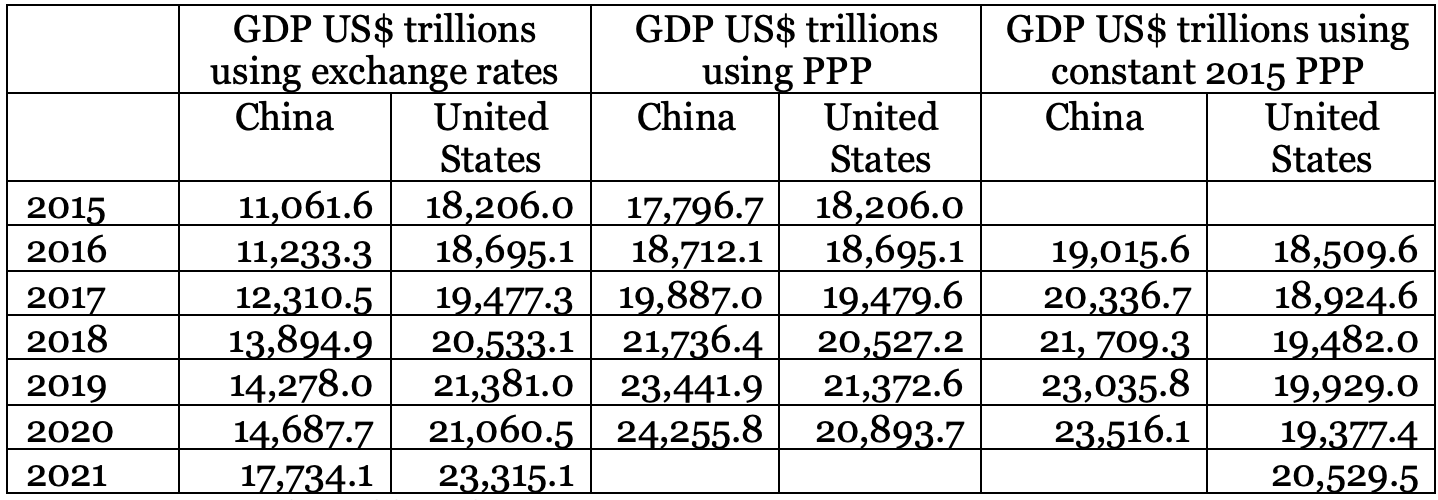

Thus, as can be seen in Table 1 below, if we use exchange rates, in 2021, the most recent year for which data are available, the US GDP is $21,060.5 trillion which is substantially larger than the $17,734.1 trillion for China. However, if we use PPPs in 2020 (the latest year for which data are available) then the US GDP was only $20,893.7 trillion, significantly less than the Chinese GDP for that year which was $24,255.8 trillion.

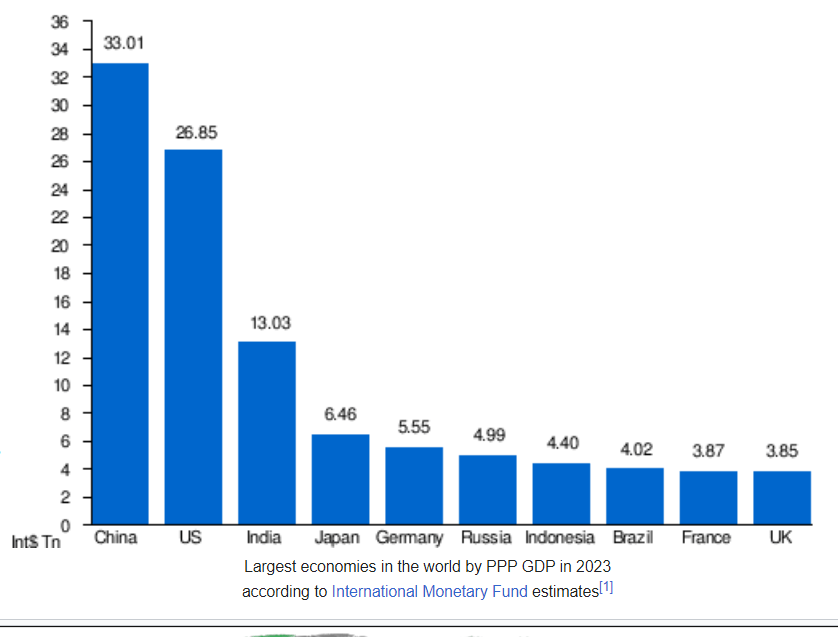

Editor’s update: According to IMF estimates, in 2023 China’s GDP PPP will be $33.01 trillion, compared to the USA which will be $26.85 trillion.

Figure 1. Top 10 Economies 2023

(World Economic Outlook Database, April 2023)

Table 1. Comparison of US and Chinese GDPs (2015 to 2021)

Furthermore, as can be seen, China overtook the US GDP and became the biggest economy in the world back in 2016. And since then, the average annual growth rate of the Chinese economy in constant PPPs has been 5.5 per cent, while the US growth rate has only been 1.4 per cent.

Future Chinese economic growth relative to America’s

The other bit of wishful thinking is that China’s economic growth will slow so much that it will not be significantly faster than the pace of US economic growth.

Like most economies as they mature, Chinese economic growth has slowed in recent years from the high rates of around 10 per cent per annum recorded as China opened up and took off. But even if we take the evidence of the last few years, Chinese GDP growth at an annual average growth rate of 5.5 per cent is still nearly four times as fast as America’s growth rate.

Also, the assertion that Chinese capacity to innovate is falling off, is another example of believing what you wish for. Even the Australian Strategic Policy Institute – no friend of China’s – has found that China is the leading country in 37 of the 44 new technologies that matter most for the future.

The reality is that the US productivity growth rate has declined too. Indeed, the US has a fundamentally flawed economic strategy, with a structural budget deficit of around 7 per cent of GDP which is putting upward pressure on its interest rates and the exchange rate.

The US likes to blame China for a loss of markets, but it is America’s overvalued exchange rate that is principally responsible for its balance of payments current account deficit equivalent to 3.8 per cent of GDP in 2022, while China had a surplus equivalent to 2.7 per cent of its GDP. This over-valued US dollar exchange rate is reducing the competitiveness of US industries and thus reducing their future growth prospects.

Source: The above is an extract from an article by Michael Keating in Pearls and Irritations, 12 June 2023. ‘Why is America so reluctant to acknowledge China’s economic power?’, https://johnmenadue.com/why-is-america-so-reluctant-to-acknowledge-chinas-economic-power-p1/