Securing copper supply: no China, no energy transition. Inefficiencies of shifting away from China for critical minerals would increase the cost of finished goods and delay the energy transition.

The global shift toward clean energy and decarbonisation hinges significantly on copper. With the increasing demand for copper, Western efforts to secure critical minerals and reduce reliance on China’s supply pose serious challenges as the effects on downstream processing and semi-manufacturing are frequently disregarded.

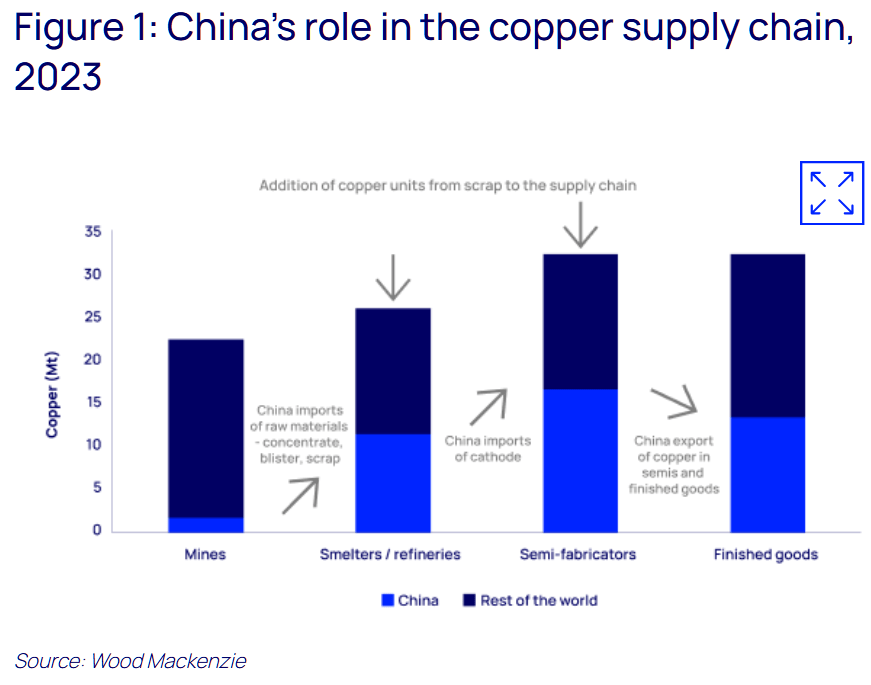

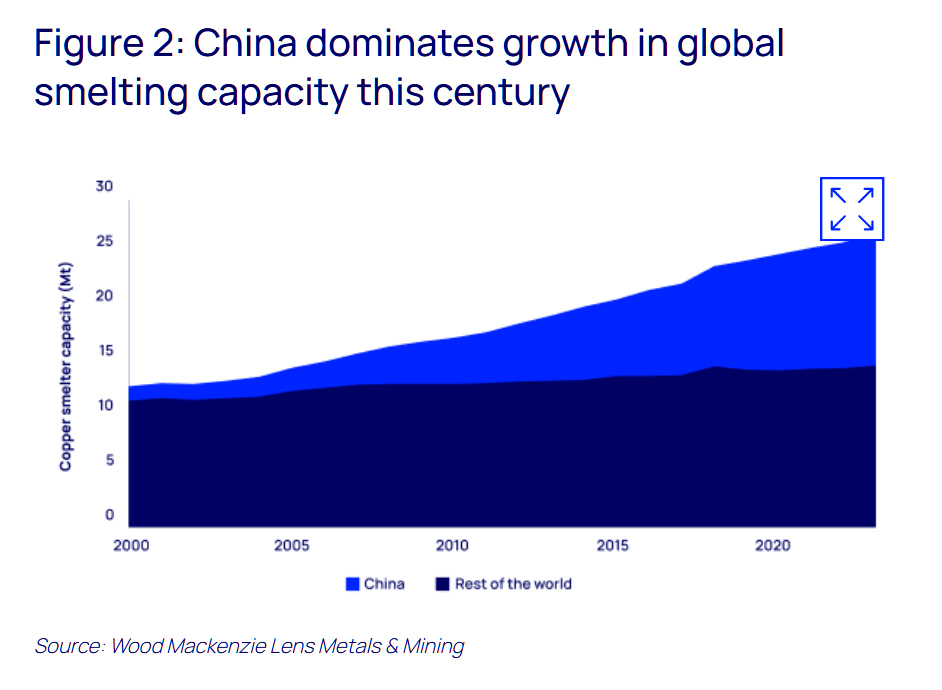

The world cannot achieve decarbonisation without copper, a crucial component in electrification. China dominates copper mining, downstream processing (smelting and refining) and semi-manufacturing.

“replacing China’s smelting and refining capability alone to meet the rest of the world’s demand would require nearly US$85 billion”

According to Wood Mackenzie, demand for copper is expected to rise by 75% to 56 million tonnes (Mt) by 2050, necessitating substantial new investment.

Shifting away from China will require massive investments in new copper processing and fabrication facilities. The August Horizons report, Wood Mackenzie’s ‘Securing copper supply: no China, no energy transition,’ states that replacing China’s smelting and refining capability alone to meet the rest of the world’s demand would require nearly US$85 billion.

“A scenario without China for the copper supply chain would require a substantial increase in processing capacity to meet energy transition targets,” said Nick Pickens, research director, global mining at Wood Mackenzie.

Source: China Environment Times, 15 August 2024. https://www.chinaenvironmenttimes.com/article/735681374-shifting-away-from-china-for-critical-minerals-would-increase-costs-and-delay-the-energy-transition-warns-wood-mackenzie

Read: Wood Mackenzie report ‘Securing copper supply: no China, no energy transition’

https://www.woodmac.com/horizons/securing-copper-supply-china-energy-transition/