We republish this important and extremely informative article by Professor Michael Dunford, surveying and explaining China’s development path, 1949-2022. We recommend this thoroughly researched and detailed article to readers.

Abstract

China’s path is conceived as a transition of an economically under-developed and semi-colonised country of the Global South into a modern socialist country in a multipolar world where successive steps (modes of regulation) were shaped by China’s external environment (uneven and combined development) and a succession of contradictions and crises encountered along the way. Three phases are examined: a turbulent phase of socialist construction in a context of capital shortage and United States (US) embargoes, a phase of reform an opening up in an era of neo-liberal globalisation whose early roots lay in early 1970s rapprochement with the US, and a New Era dating from 2017. In each phase crises and contradictions saw waves of reform involving successive joint transformations of economic structures and institutions, while each phase was anticipated in the years that preceded it, so opening-up started in the early 1970s with the rapprochement with the US and aspects of the New Era concern with innovation, green development, common prosperity and an equitable global order started to emerge earlier.

1 Introduction

China is one of the world’s most ancient civilizations marked by the reproduction of recognizable Chinese social, political and cultural characteristics. These characteristics were shaped by several thousand years of dynastic and imperial rule, by earlier socio-political orders made up of an ocean of local rural communities centred around patriarchal families, a single centre of political power and hierarchical administrations occasionally removed as a result of the loss of the Mandate of Heaven (expressing the dependence of the political legitimacy of ruling elites on the consent and wellbeing of the great majority of the Chinese people) and by Confucian, Daoist, Buddhist, Legalist and more recently Marxist values and thought that exercise important influences to this day.

Until the Eighteenth Century, China was a world leader in science and technology. In 1750 it accounted for 32.8% of world manufactures. By 1860, however, its share had declined to just 19.7%, and, by 1913, it was a mere 3.6% (Bairoch 1997: volume 3, p. 860) (Bairoch, volume 3, 1997: 860). In the nineteenth and early twentieth centuries neither the crisis-ridden Qing (Manchu) Dynasty nor the post-2011 Nationalist (Guomindang) governments managed to overcome the obstacles to industrial modernization, and the devastating impacts of the military, political and commercial penetration of China by foreign colonial powers and of Japan’s attempt at conquest. In more than one hundred years of humiliation, China was forced to sign unequal treaties, cede sovereignty and territorial rights to nineteen foreign powers and pay huge financial indemnities, while its real GDP per capita declined from 2011 US$ 926 in 1800 to 439 in 1950 (Bolt and van Zanden 2020).

China’s situation was a reflection of the wide differences that emerged as a result of the dynamics of uneven and combined development that saw western powers (Great Britain, France, Germany, the United States (US) and Japan) embark first on transitions from traditional (often feudal) societies to capitalism and pull away economically from the rest. As Marx (1976 [1867]: wrote:

‘The different moments of primitive accumulation can be assigned in particular to Spain, Portugal, Holland, France and England, in more or less chronological order. These different moments are systematically combined together at the end of the seventeenth century in England; the combination embraces the colonies, the national debt, the modern tax system, and the system of protection’

These moments saw the transformation of the feudal mode of production, the rise of commercial capitalism and colonialism, successive industrial revolutions and new waves of colonial and imperial expansion. As Marx and Engels (1969 [1848]: originally anticipated, however, the rise of capitalism did not create ‘a world after its own image’. Instead, up to the Second World War

‘[i]mperialism, or the … supremacy of finance capital over all other forms of capital means the predominance of the rentier and of the financial oligarchy; it means a small number of financially “powerful” states stand out among all the rest’ (Lenin 1974 [1916]: , pp. 238-9).

In much of the rest of the world, processes of uneven and combined development (U&CD) saw the insertion of dependent capitalisms into seas of non-capitalist predominantly peasant societies ruled by coalitions of landlords, warlords and bourgeois interests allied with core colonial and imperial powers. These great powers were themselves impelled to expand often at the expense of one or more of the others, leading in the twentieth century to two world wars. These two terrible conflicts were interspersed by a profound economic crisis of liberalism and the emergence of Communism, Fascism and Social/Christian democracy as alternatives to a liberal order that was widely seen to have failed. And yet a new liberal order emerged after the middle of the 1970s.

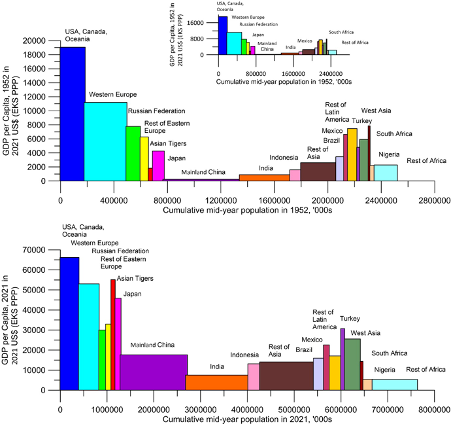

Figure 1 World GDP and population, 1952 and 2021. Source: elaborated from The Conference Board (2022)

In 1952, at the start of the post-war era, China was according to the Conference Board reports the poorest of 110 countries (where there were no data for Yugoslavia and former Soviet Republics) with a GDP per capita in 2021 international dollars, converted using Purchasing Power Parities, of $233.8. Next came Myanmar ($427.9) and Mozambique ($553.1). India was ninth poorest ($884.9). The corresponding figure for Hong Kong was $4,282.2 and for Taiwan was $1,833.0. In 2022 China was, however, 71st of 131 countries ($20,348.9 per capita) and had joined the upper middle income countries. In that year its aggregate GDP was the largest in the world ($28,609.9 billion) followed by the US ($70,848.8 per capita and 331.9 million people), India ($8,051.4 per capita and 1,315.5 billion people) and Japan ($46,001.0 per capita and 126.1 million people). China’s (and India’s) high ranks were due to the size of their populations, which are plotted on the horizontal axis in Figure 1. Moreover, China was the world’s manufacturing workshop, its largest exporter of goods and services, second largest importer, and second largest exporter of capital, the holder of huge foreign currency reserves, owner of a currency that is increasingly used to settle international payments (reaching 7% in 2022 according to the Bank for International Settlements) and a country that plays increasingly important foreign aid and development finance roles. By 2020 China had lifted all of its citizens out of extreme poverty, and in 2021 the Communist Party of China (CPC) achieved its first centennial goal of constructing a moderately prosperous society.

These remarkable transformations were enabled by the defeat of Japan, the defeat and flight to Taiwan of the nationalist forces in the Civil War and the arrival in power of the CPC, and they were a consequence of the path the CPC and its allies charted, starting in 1949 when Mao Zedong announced on the founding of the People’s Republic of China (PRC) that the Chinese people had ‘stood-up’.

China’s subsequent path involved the joint transformation of economic structures and institutions in a series of transformations designed to continue the forward movement, while dealing with successive contradictions generated in each phase of development (Aglietta 1976, Dunford 2015, 1990) and in each of a succession of crises (Wen 2013, 2020, Yiying Zhang et al 2019). Moreover, these transformations (modes of regulation) were a result of combinations of on the one hand societal interaction and the impacts of external geoeconomic and geopolitical circumstances (combined development) and on the other internal contradictions and crises (Dunford et al 2021, Rosenberg 2013).

In general terms one can identify three main eras. Characteristics of these eras were anticipated in steps that preceded them and were shaped by the contradictions that emerged at each stage, a succession of crises and the evolution of China’s external environment: (1) the years from 1949 in which China was embargoed by the US (Zhang, cited in Losurdo 2008: 287-92) and sought under the leadership of Mao Zedong and initially with Soviet assistance to develop sovereign industries through worker mobilization and fair distribution in a context of an acute capital shortage; (2) reconciliation with the US, acquisition of western loans and technologies from the 1970s and, at the end of 1978, under the initial leadership of Deng Xiaoping, the adoption of reform and opening-up (改革开放 – gǎigé kāifàng), which saw the development of capitalism (although to a much smaller extent than is often suggested) alongside other modes of production in a context of state guidance (politics remained in command), with the aim of developing the productive forces and accepting that some people and some places would get rich first, while expecting that subsequently they should help others get rich; and (3) a New Era under the leadership of Xi Jinping announced at the 19th CPC Congress in 2017 whose goals include the reassertion of the authority of the CPC to carry out the technological, social, cultural and economic tasks required to transform China in the years up to 2035 from an upper middle-income, low complexity manufacturing and export-dependent country into one that is high-income, innovative, self-reliant and sustainable. These steps are conceived as the first and second (New Era) phases in the realisation of the primary stage of socialism (Cheng 2022), and as steps on the path to the ‘great rejuvenation of the Chinese nation’ and the emergence of China as a ‘modern socialist great power’ (Xi 2021). As in the past, the New Era was anticipated as early as the start of the new millennium, when reform and opening-up continued, yet with greater attention to the goal of ‘common prosperity’ and correction of all kinds of imbalances and contradictions associated with the reform era. In addition, it was shaped by a changing international environment in which the US and its allies sought and are still seeking to prevent the return of China and ensure continuing US global dominance and control (see also Central Committee of the Communist Party of China 2021).

This interpretation challenges the notion that the events set in motion at the very end of 1978 amounted to an ideological change of course, not least as the opening to western capital and integration into world markets dated from at least the early 1970s, and were in fact envisaged in the years up to 1949. Second, it challenges common negative assessments of the first thirty years of the new China and, indeed, sees it as laying the foundations for later developments in an overall transition to socialism. Third, it emphasises the significance of successive reforms (modes of regulation) designed to address internal and external contradictions: a sequence clearly identified and explained by Chinese scholars (Wen 2013, 2020, Yiying Zhang et al 2019). Fourth, it suggests, as already mentioned, that the entire path is connected with earlier phases laying the foundations for later phases, and with reforms at each stage addressing contradictions generated at earlier stages. More generally, it is rooted in an interpretation that sees societal interaction and external geoeconomics and geopolitical circumstances (combined development) and internal contradictions and crises as playing a more important role in shaping development paths than ideological conflicts and domestic political intrigues (even though they did and do exist).

2 Socialist revolution and socialist modernisation, 1949-1978

China’s initial plans included a new democracy revolution, amounting to a joint dictatorship of all the revolutionary classes (the workers, the peasantry, urban petty bourgeoisie and national bourgeoisie) under the leadership of the proletariat (Mao 1940). However, it quickly gave way to a socialist revolution due to an inherited inflationary crisis and the sanctions imposed as a result of China’s entry into the Korean War (抗美援朝 – kàng měi yuán cháo – Resist US Aggression and Aid Korea) and its role in helping drive the US-led coalition back from the Chinese border to the 38th parallel.

As one of the first steps, China implemented a land reform codified in a 1947 Draft Land Reform Law transforming rural social relations of production.[i] In the words of a 2021 White Paper:

‘The Party’s first generation of central collective leadership under Mao Zedong regarded the liberation of peasants as the fundamental issue of the revolution, led the people to launch the Agrarian Revolution to realize the goal of “the land to the tiller”, overthrew the rule of imperialism, feudalism, and bureaucrat-capitalism, won victory in the New Democratic Revolution and established the PRC, bringing an end to sustained oppression, exploitation of the people, frequent wars, and partitioning of the country, and realizing the goals of national independence and people’s liberation. This helped to remove the obstacles to China’s progress, and created the political conditions it needed to eradicate poverty, regain national strength, and realize prosperity for everyone. … Land reform was rolled out across the country, abolishing the feudal land system that had endured for over 2,000 years. This removed the major institutional obstacle to eliminating poverty. Socialist transformation was carried out in agriculture, individual craft industries, and capitalist industry and commerce. The establishment of the socialist system provided a basic institutional guarantee for addressing the root causes of poverty (The State Council Information Office of the People’s Republic of China 2021).

At the centre of any process of development is capital investment (and human capabilities). Capital investment depends upon the availability of an investible surplus, in excess of consumption requirements, and on the effectiveness with which it is deployed (governance capacity and social relations of production). With no overseas dependencies from which they could extract an investible surplus, countries such as China that industrialized later than the world’s imperial and colonial powers could acquire savings to fund investment only internally through the depression of domestic living standards (extraction, for example, of a surplus from the rural population by means of a price scissors) or internationally by borrowing and incurring debts to international creditors. In 1940, in a speech entitled ‘On coalition government’, Mao Zedong had declared that

To develop industries, we need a large amount of capital. Where can the capital come from? It can only come from these two areas: mostly rely on our own accumulation, but at the same time seek help from outside. If foreign investments are beneficial to the Chinese economy and committed to abide our laws, we welcome them…. after thorough political and land reforms, we can develop light industry and agricultural modernisation on a large scale. On this basis, we have a huge capacity for foreign investments government (Mao 1945 [1994]: , cited in Cheng (2023))

Just as the planned coalition with the national bourgeoisie was set aside, so were the plans to attract developed country loans and investment (at least until the US blockade was lifted in the early 1970s). Instead, China sought, first with Soviet assistance, to develop an economic order comprising large-scale, domestically-oriented and capital-intensive state-owned industrial enterprises (SOEs), danwei-provided welfare services, a People’s Bank that received deposits and lent to enterprises, a Soviet-style planning system, worker mobilization and fair distribution in a context of an acute capital shortage. In the countryside the rural population was organised into collective farms creating markets for equipment and permitting the appropriation of rural food surpluses, ending the centuries-old immobility of the countryside and providing resources for industrialization: what Preobrazhensky (1965 [1920]: would have called primitive socialist accumulation, where expansion of the socialist industrial sector requires a surplus product in a society where surplus-value no longer exists. This wave of industrialization Included the development of strategically important military and military-related industries and involved considerable reliance on Soviet support: the Soviet Union renounced territorial claims in resource-rich Manchuria, and China accepted considerable Soviet technical assistance, vocational education, low-interest loans and help with the design and implementation, starting in the period of the First Five Year Plan (FYP), of 156 key joint projects (Chen 2015, Dunford et al 2021, Changpei Wang 2006).

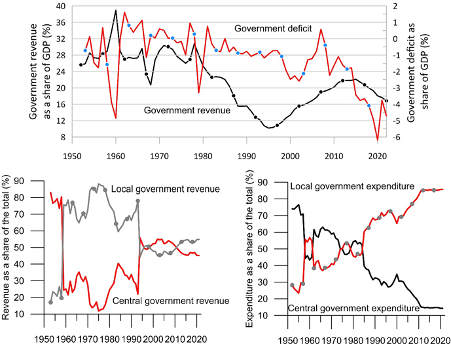

Figure 2 Chinese central and local government revenue and expenditure, 1952-2022. Source: elaborated from (National Bureau of Statistics: NBS 2023)

In the first 30 years, development paths and choices were profoundly shaped by national revenue considerations (Figure 2). Central government expenditure included the cost of defense, administration, higher education, transfers to subnational government to finance planned expenditure on administration, health, education and of centrally financed investment projects. Government revenue depended on the value of industrial and agricultural output. The rural population fed and housed itself, while surplus food fed the rest of the population and raw materials such as cotton were provided by the agricultural to the industrial sector. The agricultural surplus was acquired through quota, over-quota and market sales. Agricultural tax provided about 10% of government revenue, with much of the rest coming from taxes on industrial, commercial and service SOEs and their profits. The government could also sell bonds, or, in the early 1950s and 1970s, obtain foreign loans from, respectively, the Soviet Union and western countries.

In the second half of the 1950s relations between China and the Soviet Union started to deteriorate. In 1956, in ‘On the ten major relationships’, Mao Zedong called for a Chinese path to socialism reflecting the overwhelming demographic weight of China’s rural masses and a more balanced model of development that differed from that of the Soviet Union and involved the joint development of agriculture, light and heavy industry (Mao, 1977 [1956]). At the time of the preparation of the Second FYP for 1958-62, the Soviet Union wanted to replace aid with trade, with China exporting low value raw materials and agricultural products for high value Soviet machinery and equipment. As the countries disagreed, access to external capital resources declined, and, in 1960, all Soviet advisers and technical drawings were withdrawn. In 1962 Soviet machinery exports to China stood at just 4.58% of their 1959 value (Klochko 1971: , p. 560). China, moreover, had to repay Soviet loans.

Confronting a shortage of capital and an inherited centralized system of capital-intensive industries, in order to continue to industrialise China had no choice other than increased self-reliance, reduced dependence on central government funded industrial investment, a decentralization of economic authority and rural industrialisation. In the first phase of the Second FYP (Great Leap Forward and People’s Commune), the CPC Central Committee accordingly decided to mobilize ‘local enthusiasm’ drawing on comprehensive and multifunctional People’s Communes (Shen and Xia 2011) and relying on labour force mobilization to compensate for insufficient capital. In 1958 local government expenditure soared from 29.0% to 55.7% of the total (Figure 2). By the end of the year a need to correct errors was already perceived.

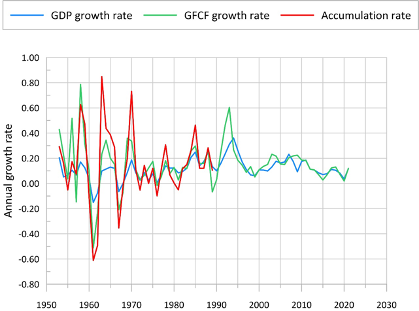

Figure 3 Turbulent growth and accumulation in China, 1952-2022. Source: elaborated from (Comprehensive Department of the National Bureau of Statistics 1990, National Bureau of Statistics: NBS 2023)

In 1959, however, the central government started to repay Soviet loans with agricultural and raw material exports. As a result, in 1959 and 1960 the central government fiscal deficit soared (Figure 2). At a local level and in the countryside the absence of technical and management skills saw the adoption of ill-informed strategies which in conjunction with three years of difficult climatic conditions had devastating consequences.

Although the Great Leap Forward gave way to a second phase of economic structure adjustment, the speed of accumulation dropped dramatically (Figure 3). The value of industrial output which had stood at ¥70.4 billion in 1957 and ¥165 billion in 1960 declined sharply to stand at ¥85 billion in 1962 (7.2% of the planned amount completed). In agriculture a slight increase in 1958 was followed by an average annual decrease of 4.3% compared with 1957. The overall output decrease of 23% resulted in the tragedy of a large number of abnormal deaths in three disastrous years (1959-61).

In 1960 a vortex of decline in cities and towns saw the government implement the first of the large-scale transfers of young people (some 10 million) to the countryside (上山下乡- shàng shān xià xiāng). In 1961 sixty clauses for agriculture increased incentives to raise output: decision making was moved down to village production teams, and space for private production was increased.

As a result in the early 1960s the economy recovered. Changes in the external situation saw however a new change of course: although a path with greater emphasis on agriculture and light industry was considered, the conflict with the Soviet Union, the official entry of the US into the Vietnam War in 1964, conflicts on the Indian border and a Taiwanese offensive saw China adopt Third Front Construction (三线 – sān xiàn). At that time China’s industrial capacity was concentrated in northeast and coastal areas vulnerable to Soviet and US attack, and so, in 1964, a decision was made to relocate strategic activities and create a complete defense and heavy industry, transport and science and technology system in dispersed localities in the mountains and valleys of thirteen provinces and autonomous regions in the central and western parts of China.

The proposals for four modernizations (agriculture, industry, science and technology, and defense) which date from the early 1950s were in effect set aside, and the main priorities of the Third FYP, which did not start until 1966, were war readiness and national defense construction. The localities chosen, while distant from areas of potential military confrontation with the Soviet Union or the US, were for the most part not conducive to industrial development and lacked infrastructure, while dispersal sacrificed potential external economies, and industrial transfer resulted in long supply lines. And yet in sixteen years and three FYPs between 1964 and 1980, the state invested ¥205,268 million (some 40% of total capital investment) in Third Front zones. In 1965 and 1975, the state spent almost half of national capital construction funds on the construction of the ‘Third Line’ strategic area. In 1965 and 1971, China’s total investment in ‘Third Line Construction’ reached ¥34.08 billion. This figure does not include self-raised provincial investment funds committed to ‘Small Third Line’ construction.

More than 1,100 large and medium-sized industrial and mining enterprises, scientific research establishments and tertiary education institutions were established in Third Front areas. This transfer was not without precedent, as it was what the Guomindang had done in the face of Japanese aggression in the 1930s when it moved strategic industries to Sichuan and Yunnan and the capital to Chongqing. And it did lay some of the foundations for western development in the new millennium. The generation of capital depended mainly on the creation of government and enterprise surpluses through the operation of a price scissors that compressed the prices at which the government purchased agricultural products and reduced wage costs in cities. Although strategically important, the capital that was invested in Third Front projects generated very low rates of return. In a context of strong population growth, GDP per capita increased slowly. In 1967 the government deficit soared as a share of GDP (Figure 2), and in 1969-70 tens of millions of educated young people were sent to the countryside for the second time.

May 1966 saw the start of the great Proletarian Counter Revolution (无产阶级文化大革命- wúchǎnjiējí wénhuà dà gémìng) (CR). In some respects the CR was part of a global movement of radical youth in the 1960s and 1970s. In the army, industry, agriculture and the administrative, science and education superstructure new accountable management and role models were promoted, drawing on exemplars including the 1960 Angang Constitution, the Daqing Spirit (大庆精神 – dàqìng jīngshén), Dazhai village reconstruction and the development of China’s nuclear arsenal. The aim was to sweep away old ways, including the disempowerment of the masses, and contribute to a worldwide class struggle against capitalists, landlords, officials and teachers, and against colonialism, imperialism and threats to sovereignty.

Officially the CR did not end until 1976, although it was intended to last for one year. On its launch mass mobilizations, red guard activism and social protests led to an extraordinary wave of violence, chaos and disorder which largely explain the official judgement delivered in 1982 by the CPC Central Committee that it ‘was responsible for the most severe setback and the heaviest losses suffered by the Party, the state and the people since the founding of the People’s Republic’ (Central Committee of the Communist Party of China 1981).

As violent, reckless and destructive and as great a source of anger, resentment and retaliation (Han 2008: , Chapter 7) as it was, the violence, chaos and disorder were short-lived. This phase largely ended in 1967 when the CPC restored control, and more decisively ended in 1968 (though see Nianyi Wang 1988: , p. 337) when the 1966, 1967 and 1968 junior and senior high school student cohorts were sent to the countryside with universities closed until 1970. This step was a response not just to the need to reign in the Red Guards but also to the afore-mentioned 1967 economic crisis. This crisis was a consequence of an acute shortage of capital stemming from the repayment of all foreign loans and the devotion of resources to unremunerative Third Front construction, and was associated with the existence of insufficient urban industrial investment and weak employment prospects for university graduates at a time of strong demographic growth. The movement to the countryside eased unemployment risks and also addressed food supply problems.

In this era, in the countryside a rudimentary and inexpensive but relatively effective health care system was put in place, and rural elementary education expanded, with an emphasis on practical skills, while scarce capital was replaced by the mobilization of labour on a massive scale (Dazhai agriculture) to construct reservoirs and irrigation facilities, improve land and apply fertilizers and implement simple mechanization, increasing yields (Han 2008, Huang 1990: , p. 224). Commune industries were developed in accordance with the 4th FYP (1971-75) proposals for the development of small enterprises: small steel, small coal mines, small machinery, small cement and small fertilizer enterprises all grew. The commune and production brigade enterprises (社队企业- shè duì qǐyè) (CPBEs) of that era were the forerunners of the township and village enterprises (乡镇企业 – xiāng zhèn qǐ yè) (TVEs) of the 1980s.

In 1967 and 1968 Chinese economic growth was disrupted and slowed in 1974 and 1976 but from the trough in 1967 to the trough in 1976 the average annual rate of real GDP growth was 7.8% (Figure 3). In the mid-1970s, however, when government deficits increased (Figure 2), millions of educated young people were sent for the third and last time to the countryside. Again the aims were to avoid high levels of unemployed urban youth and meet their subsistence needs. On this third occasion the degree of resistance was greater than in the 1960s.

Around 1966 the rapid growth of the Asian Tigers was set in motion. In 1971 the US abandoned the Bretton Woods fixed exchange rate system, marking the start of a fiat currency and floating exchange rate system, while declining profitability and falling productivity growth in G7 countries was indicative of an approaching economic crisis that would see a significant offshoring of advanced capitalist country productive activities to low-cost countries. In the same year ping-pong diplomacy and diplomatic exchanges started. With the US seeking to isolate the Soviet Union, and China anxious to participate in international trade and investment subject to respect for its sovereignty, the US blockade was lifted. In 1972 the visit to China by US President Ricard Nixon opened the path to the establishment of formal diplomatic relations in 1979. Again changes in the international context and the character of inter-societal interaction (combined development) played a central role in shaping China’s path.

In this new international situation China started to enter in a managed way the western-dominated international economic and political order, while keeping for the most part a low profile and never claiming leadership, as Deng Xiaoping later advised (韬光养晦 – tāo guāng yǎng huì). This stance reflected Chinese diplomatic thought which has consistently opposed hegemony and sought peaceful coexistence.

As tensions eased and an economic crisis in Western counties led corporations to seek new markets, Mao Zedong, Zhou Enlai and Hua Guofeng embarked on a new modernisation drive. In 1973 the Four-Three Scheme (四三方案 – sì sān fāngàn) or the 43 Plan saw the Chinese government secure loans worth US$4.3 billion that permitted China to import complete sets of technical equipment for Chinese owned industries from the US, Federal Republic of Germany, France, Japan, the Netherlands, Switzerland, Italy and other Western countries and to develop coastal industries producing petroleum, metallurgical and electronic products, precision instruments, chemical fertilisers and synthetic fibres. The goals of the State Planning Commission were to increase the output of consumer goods to generate export revenues, realise the four modernizations (as in the 1960s until deflected by the security situation) and to meet the desire of Chinese consumers for modern consumption goods whose supply had been restricted to provide resources for capital investment. In 1978 agreements were signed with foreign countries for twenty-two large projects expected to require US$13 billion in foreign exchange (¥39 billion) (Haibo Wang 1998: , pp. 498-499). And then in the last days of 1978 China decided to embark on ‘reform and opening-up’. As in the case of other developing countries, export and export-surplus orientations were considered necessary to fund investment and service debts.

In the first 30 years China’s growth had been characterized by a very great deal of turbulence (Figures 2 and 3), yet the average real GDP growth rate in 1952-78 was 6.2%. China had established a core strategic industrial system and in the 1970s the ‘green revolution’ resulting from the earlier establishment of agricultural research and agricultural extension services that saw the development of new high-yielding seed varieties, along with the use of chemical fertilisers and improved irrigation facilities solved the food problem that had bedevilled a country with 20% of the world’s population but just 8% of its cultivated land, 5% of its water resources and 3% of its forest stock for centuries.

The new China saw life expectancy increase from 35 in 1949 to 57 in 1957 and 68 in 1981, while its population increased from 554.4 million to 1,014 million. According to The World Bank (1981: , 1979 life expectancy of 64 was higher than the average for 51 for low-income countries and 61 for middle-income countries, adult literacy stood at 66% compared with 39% in low income and 72% in middle income countries, while net primary school enrolment (93%) was just short of that for industrialised countries (94%). In 1978 per capita rural income stood at ¥134 Yuan (PPS$81), while the per capita income of urban residents was ¥343.4 (PPS$208) yet the latter increased to ¥454.2 if one included the value of welfare, medical and other in-kind provision (Xinmin Zhang 1994). In 1978, although there were many status and regional differences, China had a vast, predominantly young, healthy and educated population and was relatively egalitarian with small income inequalities within communes and cities.

2 China-US rapprochement and reform and opening-up

2.1 The first phase of reform and opening-up: decentralisation and management autonomy

In the late 1970s imports of western machinery and equipment gave rise to a fiscal crisis due to the requirement to match loans and to service and eventually repay debt. In 1979 the deficit exceeded -¥13.5 billion or 11.8% of government revenue (Figure 2). A fiscal crisis and a need to ease cost pressures on SOEs deriving from the requirement to absorb excess labour to preserve social stability when unemployed youth could no longer be sent to the countryside reduced surpluses and state revenues and implied another (as in the Great Leap Forward) devolution of investment responsibilities to local entities.

Confronted with these difficulties, China embarked on the first phase of reform and opening-up. This phase extended from the very end of 1978 to 1993. It involved the development of management autonomy and the gradual reform of prices, but it led to an inflationary crisis and an attempted colour revolution at the end of the 1980s, a recession (see Figure 3) and a renewal of inflation in 1993.

Management reform was introduced first in the countryside, where the planning system was weakest: in 1979 the purchase price of grain output was increased by 20%, and in 1981 the household responsibility system (HRCS) involving a combination of payment in kind and in cash (bāo gān zhì) was introduced. Agricultural households were allowed to contract land, machinery and facilities from rural collective organizations, were assigned a residential plot (zhái jī dì) and were expected to be self-sufficient. In 1983 use rights to contracted land were set at 15 years, and in 1993 were extended for another 30 years. In 2003 a Rural Land Contract Law was passed specifying contracts length for arable (30 years), grass (30-50 years) and forest land (30-70 years). Households were allowed to make decisions subject to the contract, and could sell any surplus over collective and national quotas. The system involved a dual system of prices: prices determined by the plan at which quotas were sold to the state, and market prices for surplus output. Over time these quotas were reduced. Assisted also by reduced farm input and equipment prices, these changes saw strong increases in farm output (33% in 1978-84) and income. In effect the central government withdrew abandoning responsibilities for education, medical care and social security (Y. Zhang et al., 2019).

In 1980 it was decided to adjust the relationship between central and local finance (see Figure 2). In 1982 interim provisions were put forward: instead of eating from a big pot of rice (吃大锅饭- chī dà guō fàn) a new system of eating meals prepared on separate stoves (分灶吃饭- fēn zào chī fàn) was adopted, dividing central and local government revenues and expenditures, cutting subsidies to local governments, permitting them to retain a share of tax revenue over and above a fixed central government quota and allowing them to generate revenue. This reform strongly encouraged local officials to promote local economic development. What followed was a strong process of monetization, as things that did not generate revenue were transformed into things that did, with local government later capitalizing the use value of land and inflation reducing debt.

In small towns the number of TVEs, as former CPBEs were called from 1984, increased rapidly absorbing surplus rural labour released by rural agricultural reform. TVE growth was made possible by pre-reform conditions. In particular, the Maoist emphasis on local self-sufficiency resulted in substantial provincial and local industrial decentralisation and specialisation. Before the reforms 78% of Chinese industrial enterprises were small-scale, labour-intensive collectives controlled by local governments (Nee 1992). Multi-level decision-making and the early establishment of CPBE-SOE relationships also contributed to the subsequent expansion of subcontract relationships. In 1979 the central government provided a number of incentives to CPBEs: no tax for three years on new enterprises; and the opening up of agricultural, consumer good and local produce markets (fertilisers, equipment food, textiles and clothing). The subsequent rapid growth of TVEs increased the demand for industrial goods and market output, scale economies, and market competition and reduced the significance of the planned sector. In 1996 TVEs employed 135.1 million people.

All of these measures transferred responsibilities downwards and permitted greater local initiative and diversity, while limiting central government financial responsibilities. The central government did, however, continue to play a role in the provision of investment resources for expanded reproduction using revenue from SOEs, the state budget and loans.

In 1983, after some experimentation with greater SOE management autonomy in Sichuan, moves were made to devolve the management of urban enterprises to managers, while in 1984 a contract responsibility system separated ownership and operating rights. After meeting plan obligations in volume terms, enterprises were allowed to sell additional output at market prices for profit, and, as a result of a fiscal reform, paid a tax on profits instead of remitting all profits to the state. At that stage, however, prices moved against industrial activities, and competition increased.

In 1979 joint venture enterprises with foreign companies were permitted (see Section 2.3), although it was a strategy to retain control as well as stimulate direct foreign investment. In 1979 and 1984 the banking system was also reformed first with the establishment alongside the People’s Bank of China (PBOC) of three banks to provide credit for agriculture, construction and commerce (Agricultural Bank of China, China Construction Bank, and Bank of China) and then with the conversion of the PBOC into a central bank and the transfer of its credit operations to the newly established Industrial and Commercial Bank of China.

At first industrial output increased as a result of the growth of TVEs. The SOE reforms were accompanied by increases in urban wages and incomes, but not in productivity. Many enterprises made losses and incurred increasing debt with banks pressed to provide frequently non-performing loans to enable them to survive. As everyone worked for state entities, income growth was relatively general and equal. In 1985 the government abolished the state grain purchasing and marketing monopoly, but it sold the grain (grain rationing was not abolished until 1993) at a loss. Food subsidies (differences between increasing purchase prices and sale prices restricted to limit inflation and provide cheap food in urban areas) and subsidies to SOEs increased government expenditure, while the weak performance of many enterprises on which government revenue depended led to an acute need for new sources of government revenue.

A decline in the central government’s share of fiscal revenue (see Figure 2) exacerbated its financial position, and a combination of increased demand relative to output, an expansion of credit provided to SOEs and increases in liquidity increased inflation. In 1988 inflation reached 18%. Consumer prices increased from an index of 100 in 1978 to 131.1 in 1985, 216.4 in 1990 and 396.9 in 1995 (National Bureau of Statistics: NBS 2023). In these conditions resentment at the erosion of the economic security afforded to the urban population increased sharply, and was one driver of the 1989 political crisis. Other causes included growing official corruption as cadres and their families exploited the price differences arising from the dual-track price system and controlled prices of essential goods, and the activities of domestic and international institutions and actors advocating liberal reforms.

In China the outcome of the events of 1989 differed sharply from the cases of former COMECON countries: in the former Communism fell, countries fell apart, population declined and output collapsed at least initially. In even the most successful case (Poland) real GDP in 2020 was just 2.5 times that in 1989, whereas in the case of China it was 14.8 times greater (while Ukraine stood at just 0.6 times its 1989 level) (Dunford 2023). In China the leadership of the CPC remained in power, reformists in the leadership including Zhao Zhiyang who had reached the position of CPC General Secretary were replaced and overseas-funded reform agencies were closed (Ehret 2021).

The difference in outcomes were associated with different reform paths. In the past Mao Zedong (cited in Coderre 2019: , p. 34) had spoken of the need to ‘develop socialist commodity production and commodity exchange’ as had Stalin. In each case socialist and capitalist commodity production were considered to differ, and socialist commodity production was considered necessary. In 1975 Mao (cited in Coderre 2019: , p. 23) pointed out that: ‘At the moment, our country employs a commodity system, and the wage system is unequal as well, what with the eight-grade wage system, etc. Such things can only be restricted under the dictatorship of the proletariat’. In this light that one can understand the Deng Xiaoping era ‘Constitution of 1982’ which called for adherence to four cardinal principles, namely, adherence to socialist road, to the people’s democratic dictatorship, to the leadership by the Communist Party of China and to Marxism, Leninism and Mao Zedong thought.

2.2 The second phase of reform and opening-up: fiscal reform, privatisation and a socialist market economy

The crisis saw the adoption of measures to address some of the tensions (grants to SOEs in difficulty, greater control over TVEs and stricter control of rural-urban migration) and a process of deliberation. In the Spring of 1992 Deng Xiaoping undertook his Southern Journey in order to relaunch reform and opening-up and opening the way to a second stage of reform from 1994 to 2012. In 1992 the 14th Congress of the CPC adopted the ‘socialist market economy model’, corporate management methods and a Corporate Law that established limited liability and shareholding companies.

One of the first major steps was a fiscal reform (Figure 2) designed to increase the fiscal capacity of the central state. This reform involved two changes. The first was change to a reliance on tax (Value Added Tax, taxes on luxuries, taxes on enterprises with until 2008 preferential rates for foreign firms, and income tax) rather than the income of SOEs. The second was the adoption of a tax sharing system, under which local government initially depended on transfers, although it subsequently also drew on land revenues to finance its expenditure (Z. Liu 2019). A fiscal administration was also established.

SOE losses and welfare obligations raised their costs and reduced their competitiveness, while the government needed to protect its financial position. These factors contributed to the Corporate Law reform that made enterprises into public companies. In 1993-97 the government then implemented reforms that ended the iron rice bowl, allowed bankruptcies, permitted redundancies and, with the 1997 adoption of the principle of ‘zhuā dà fàng xiǎo’ (抓大放小 – grasp the large and let the small ones go) , allowed privatisation. The government decided to hold on to larger SOEs, while after the three years they were given to resolve the difficulties giving rise to losses or insufficient returns (三年脱困 – sān nián tuō kùn) 53,000 small SOEs were expected to find their own way: enterprises in non-strategic sectors (not related to national security, natural monopolies, essential public services, and high technology) that survived were to be sold either to managers and workers, or to managers, while enterprises that remained unprofitable were to be closed. As this process was in the hands of local government, many officials as well as managers enriched themselves.

The government also decided to allow redundancies. In the period up to 2004, more than 37 million workers were laid off. In 1997-2004, SOE employment declined from 107.7 million to 43.4 million (Aglietta and Bai 2013: , pp. 151-2). Change occurred however without serious conflict, due to relatively rapid economic growth and the creation of alternative employment, the generosity of the layoff (下岗- xià gǎng) programme (workers laid off received three years’ pay, pensions, health insurance and local government social security), the 1998 housing reform that sold public housing at preferential prices to their occupants and the support to laid-off workers provided by friends and extended family networks.

In the medium and longer-term, however, the effects on many families and communities were extremely serious. The privatisations were important drivers of the explosion of inequality in China in the years up to the North Atlantic financial crisis. In the new millennium ‘management buyouts’ were subject to sustained criticism especially where undervalued assets were transferred to new private companies and revenues and costs were under-reported by managers to acquire assets cheaply. In December 2004 management buyouts of large SOEs were stopped, and rules for the acquisition of smaller SOEs were tightened (Blanchette 2019: , Chaper 2), while in 2005 a new Draft Property Law of the People’s Republic of China was withdrawn pending revision due to criticism of the absence of sufficient protection of public property.

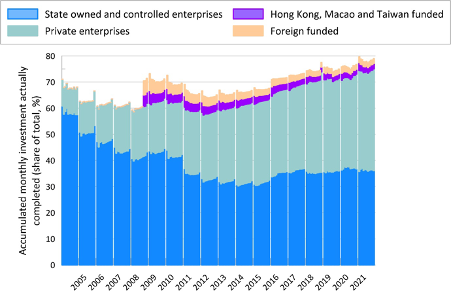

Figure 4 Fixed capital investment by state-owned and controlled, private and overseas enterprises, 2004-2021. Source: elaborated from National Bureau of Statistics: NBS (2023:

The government nonetheless retained a very significant set of state-owned and state controlled enterprises. In 2003 these enterprises were brought under the State-owned Assets Supervision and Administration Commission of the State Council (SASAC). The government also retained a state-controlled financial system that mainly funds SOEs, house purchases and local government-related urban development corporations. After the privatisations the share of state-owned and controlled enterprises in fixed capital formation declined, yet in 2020 and 2021 it still exceeded one-third of the total (see Figure 4). Moreover, SOEs occupy the commanding heights of the economy, create economy-wide externalities, invest in essential capital intensive industries, adopt a high road approach to employment, absorb labour to maintain social stability, undertake countercyclical investments and serve to limit foreign control (Qi and Kotz 2020)). The Chinese state can also draw on state-controlled sectors along with its macroeconomic and planning policies to implement effective counter-cyclical measures as in the aftermath of the Asian crisis in 1998-2003 and after the North Atlantic financial crisis in 2007-8. In each of these cases the Chinese state could raise effective demand without a system of administrative planning.

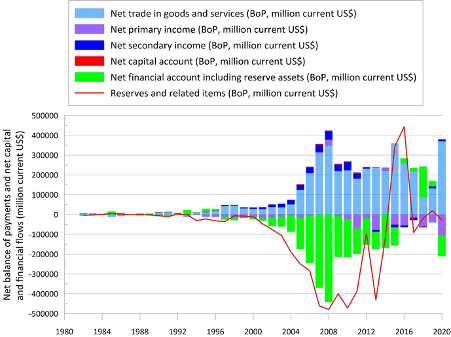

Figure 5 China’s balance of payments, 1982-2020. Source: elaborated from (International Monetary Fund 2023, PRC SAFE 2023)

2.3 Opening-up and globalisation

Alongside domestic reform, China embarked on the opening-up of its formerly closed economy to the rest of the world, transforming itself into a great commercial power. As Figure 5 shows, in 1990 China started to generate small surpluses on its trade in goods and services. China’s trade surpluses increased up to 2008, rose again in 2015 and increased in 2020 when the COVID-19 virus, first identified in China, spread around the world, and economic activity collapsed. At least until 2007-8 China’s surplus was used to purchase US Treasury debt, allowing the US to run large trade and government deficits. By 2009 China was the world’s largest exporter (followed by Germany, the US and Japan), and by 2010 the second largest importer (usually followed by Germany and Japan). Chinese merchandise trade reveals an underlying change from an economic structure dominated by assembly and processing of a wide variety of low-technology, light consumer goods to higher technology-products, although in these industries China often remains dependent on imports of the most technology-intensive components (characteristic of South-North trade relationships) (Dunford and Liu 2023).

In the 1980s, inward foreign direct investment (IFDI) increased slowly, with Hong Kong and Macao accounting for 75.5% of overseas invested projects (Hayter and Han 1998: 12), but in 1992-98 IFDI increased strongly enabling China to acquire foreign currency, accumulate foreign reserves (US$8.7 billion by 1999) and increase investment in modern plant and equipment. Greater IFDI brought new technologies and provided opportunities and access to credit for private firms that grew strongly from 10% of industrial enterprises in 1990 to 32% in 1996. In December 2001 after fifteen years of negotiations China acceded to the World Trade Organisation (WTO) and from 2004-11 saw another powerful wave of IFDI (with a dip in 2009). Moreover, after discouraging Outward FDI (OFDI), in 1999 China changed course, adopting a Go Out strategy. Chinese OFDI accelerated (net flows can be inferred from Figure 5) from just under US$ 1 billion in 2000 to US$ 56.7 billion in 2008. After a decline in 2009, OFDI rose to US$ 216.4 billion in 2016 (Dunford and Liu 2023).

With the exception of a few years, China’s net primary income was negative, reflecting net payments (investment income in the shape of profits, interest and dividends and employment compensation) to non-residents, and indicating the overall predominance of South-North relationships. Conversely, net secondary income (mostly overseas Chinese and other international migrant remittances), was until recently positive (reflecting net inward transfers by overseas and migrant communities characteristic also of many parts of the Global South) but relatively small.

As already mentioned, opening-up and China’s subsequent rapid development were made possible by two important developments. The first was a change in the international climate: the lifting of US embargoes, the end of the Vietnam War in 1973, the establishment in 1979 of diplomatic relations with the US and China’s participation in the international economic order. The second was a wave of neo-liberal globalisation. Commencing in the 1970s an internationalisation of commodity exchange, of capital and of the production process (of the technical and social division of labour) accelerated. Globalisation was facilitated by developments in transport and communications technologies and accelerated as multinational companies sought to increase/restore profitability by employing cheap labour in the Global South and establishing just-in-time global value chains. As a result prices were reduced in the Global North, and the real incomes of those in employment increased, while export surpluses were used to accumulate reserves and purchase western debt. In the 1980s and 1990s a strong internationalisation of developed country financial capital followed. Importantly, however, China entered this evolving international system in a carefully managed way. China had to make concessions especially to join the WTO, but it was able to manage its engagement and secure gains for itself due to its possession of sufficient sovereign power, avoidance of debt and reproduction of state governance capacities. These circumstances enabled it to accelerate movement along a latecomer development path on which it had embarked in 1949.

Opening-up started in 1979 with the introduction of several exchange rate measures, including the establishment of a short-lived dual exchange rate system, to encourage Chinese exports. In the same year joint ventures were permitted to encourage inward investment in certain sectors in which Chinese enterprises were not present. In 1979-80 Special Economic Zones (SEZs) were designated in Shenzhen, Zhuhai and Shantou in Guangdong Province and Xiamen in Fujian Province. These zones were located near overseas Chinese communities in Hong Kong, Macao and Taiwan Province of China, with a view to the attraction of investment and their future reunification with the Chinese mainland. Over the course of time special economic zones were multiplied first in coastal areas and subsequently in other parts of China (Weidong Liu et al 2022).[ii] By 2019 China accounted for 2,533 zones (excluding prefectural and county level zones) out of the world total of 5,400 (UNCTAD 2019).

The first special zones were designed to attract foreign investment, earn foreign currency, import technology and management expertise, open up commercial channels to markets for Chinese produced goods and services and diffuse development. Contracts were handled by local government. Competition between local governments was fierce and centred on preferential policies offering land cost, energy cost and fiscal advantages to investors, although local capacities were conditioned by administrative grade. Zones were also places for experimentation ‘proceeding from point to surface’ (由点到面 or 以点带面 – yóu diǎn dào miàn or yǐ diǎn dài miàn) and ‘implementing policy in accordance with local conditions’ (Heilmann 2018). Moreover the designation of the first zones was associated with a dual track approach (Lau et al 2000).[iii] On the one hand, the government encouraged contracts between foreign direct investors and Chinese subcontractors or joint venture partners in the processing trade, and reduced China’s exchange rate for exports from SEZs to make export processing attractive and competitive. From 1978 TVEs in labour-intensive sectors such as textiles, clothing and toys in the Pearl River Delta dealt with Hong Kong, while TVEs in Fujian dealt with Taiwan. On the other, the governmnet ensured that ordinary trade was protected, and maintained numerous capital controls. Currency convertibility was confined to banks and SOEs involved in international operations and current account holders. This course of action was important: by choosing to open up progressively, China ensured that domestic industries serving the domestic market had time to adapt and avoid being destroyed by foreign competition. Importantly, export-orientation was combined with carefully managed effective protection along with capital account controls and a slow accumulation of reserves that drove down the exchange rate. Massive investments in infrastructure and logistics and low real costs of utilities and of labour contributed to the attractiveness of investment in China and reflected specific Chinese institutional arrangements. Money wages for example were low due to the mobilization of a massive migrant labour force of agricultural Hukou holders whose reproduction costs were low as their families held contracted rural land and rural residential plots. In these circumstances industrialization and urbanization were extremely rapid, generating also widening domestic markets for goods and services of all kinds, themselves served by domestic companies and also by inward investors.

2.4 Towards a new phase

At the end of the 1970s an earlier association between the CPC goal of ‘common prosperity’ (共同富裕- gòngtóng fùyù) and egalitarianism (平均主义- píngjūnzhǔyì) was replaced by the idea of letting some people and places get rich first (一部分先富裕 – yī bùfen xiān fùyù) in order to accelerate the development of the productive forces and achieve the four modernizations. In advocating this change Deng Xiaoping repeatedly argued that:

… predominance of public ownership and common prosperity are the two fundamental socialist principles that we must adhere to. The aim of socialism is to make all our people prosperous, not to create polarization. If our policies led to polarization, it would mean that we had failed; if a new bourgeoisie emerged, it would mean that we had strayed from the right path. In encouraging some regions to become prosperous first, we intend that they should inspire others to follow their example and that all of them should help economically backward regions to develop. The same holds good for some individuals (Deng Xiaoping, Unity depends on Ideals and Discipline, 7th March, 1985, Collected Works, volume III.

In the first three decades of reform and opening-up, China achieved sustained high rates of GDP growth, but the priority attached to increases in GDP and letting some get rich first was responsible for a series of negative consequences: serious environmental damage, resource depletion, growing inequalities in income and wealth, growing rural-urban and regional disparities, increasing corruption and a rapid increase in mass incidents relating to employment, land acquisition, demolitions, pollution and official conduct. In the New Era concern was also related to cultural evolutions and especially tensions between some characteristics of China’s modernisation path and the shared belief and value systems that hold communities together (Huning Wang 1991).

These issues received increased attention in the new millennium. In 1998, the Third Plenary Session of the 15th Central Committee of the CPC (CCCPC) considered the question of agriculture and the three rural problems of agriculture, farmers and the countryside. This discussion opened the way to a succession of rural reforms designed to grant farmers secure rights to contracted land and use rights transfer, to improve rural infrastructure and public services, to establish a new socialist countryside by 2010 and from 2003 to introduce a New Rural Co-operative Medical System and minimum life guarantees in rural areas.

In 1999, China’s western development was set in motion to expand domestic demand and drive economic growth in the aftermath of the Asian Financial Crisis and to contribute to ‘common prosperity’. Measures to support Northeast and Central China followed. In 2000 to 2007, central government financial transfers reaching nearly ¥1.5 trillion and national debt, budgetary and departmental construction funds in excess of ¥730 billion were allocated to the West. In subsequent years regional gaps (with the exception of Northeast China) started to close (Dunford 2022).

A number of social and ecological priorities were also reflected in some of the expenditure lines in the ¥4 trillion (US$586 billion) fiscal stimulus plan announced in November 2008 when the North Atlantic financial crisis saw the world economy experience the sharpest downturn since the Great Depression. The plan focused on 10 major areas, including low-income housing, rural infrastructure, transport (rail, airports and roads), health and education (including school and hospital construction), energy and the environment, technological innovation, and post-earthquake reconstruction in Sichuan, and aimed to counter the global recession and improve the longer-term competitiveness of the economy. Of the total almost one-half (46.8%) was for infrastructure investment. The central government contributed 29.5% of the total budget, with the remaining ¥2.82 trillion coming from local government financing (including bond issuance) and lending by China’s state-owned commercial banks (Dunford and Yeung 2011: , pp. 36-42, The World Bank 2009).

3 A Chinese path to modernisation: new normal, domestic innovation, ecological and spiritual civilisation, common prosperity, Community of Shared Destiny for Humankind

Once the effects of the 2008/09 fiscal stimulus petered out, China stepped into a ‘new normal’ model of economic growth. New normal meant growth that would be slower, higher in quality and involve significant changes in its structure, as some sectors would decline and others would grow. This change was precipitated by the repercussions of the North Atlantic Financial Crisis, the problems generated by sustained rapid GDP growth and changes in circumstances in China itself.

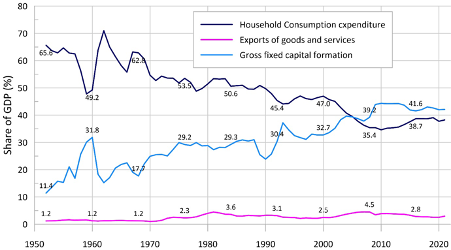

Figure 6 GDP by expenditure approach, 1952-2022. Source: elaborated from National Bureau of Statistics: NBS (2023:

As already mentioned, Chinese growth was driven by high rates of capital accumulation and investment in fixed assets. Fixed assets investment has accounted for 30% to more than 44% of GDP since 1990 (Figure 6). Capital accumulation itself depended to a significant extent on counter-cyclical macroeconomic measures and a significant state sector (Figure 4). China’s exports also increased strongly reaching 4.5% of GDP in 2007. Although the products produced grew in sophistication, China remained largely reliant on exports of cheap standardised mass products made with unskilled low-wage labour. As wages increased especially relative to other parts of the world, and the relevant cohorts of the population were largely employed, and with the population also ageing, the viability of this path diminished. At the same time the growth of China’s export markets slowed and protectionism increased. In the case of labour-intensive industries, a Third Industrial Transfer did start after 2008, as jobs were relocated to inland provinces nearer the sources of China’s migrant workforce (W. Liu et al 2016), but in other cases multinational companies moved offshore.

The stagnation of external demand which also played a role and the slowdown in growth saw the emergence of excess capacity in upstream and especially capital-intensive downstream export-oriented industries. Moreover, capital-, energy- and pollution-intensive industries were not paying their social costs. In 2015 a response was supply-side structural reforms, cutting overcapacity especially in steel, iron and coal, destocking housing in third and fourth-tier cities, de-leveraging via debt-equity swaps, and reducing costs and strengthening the weaker parts of supply chains.

In any case, in the era of opening-up the technological progress made by Chinese enterprises was in many ways disappointing, while the development of high-quality Chinese brands for middle class segments of the domestic market was limited, leaving space for domestic market penetration by foreign companies. In recent years this situation was exacerbated by developed country trade[iv] and technology export restrictions applied to imported high technology components and equipment.

In these circumstances, China’s goal was to move up the value chain to produce high-technology manufactures, increase specialisation in R&D and design and develop high-quality national brands. Although after 1978 the country had moved strongly in the direction of market-driven development, it was always government-guided. In recent years, however, assessments of past experience and increased emphasis on upgrading goals saw a considerable strengthening of industrial policy initiatives. In 2006, China’s State Council released the National Medium and Long-Term Plan for the Development of Science and Technology (S&T) (2006–2020) launching an indigenous innovation strategy and setting goals to turn China into an innovation-oriented country and a world scientific power. In 2010 in order to avoid Japan’s path the State Council of the People’s Republic of China (2010: announced its Decision on Accelerating the Cultivation and Development of Strategic Emerging Industries (SEIs) identifying as priorities seven specific industries (energy efficient and environmental technologies, next generation information technology, biotechnologies and pharmaceuticals, high-end civilian and military equipment manufacturing, new energy, new materials and new-energy vehicles) plus research into core technologies (life sciences, information technologies, aerospace, and ocean and deep earth sciences). Taxation, subsidised credit, human resource (including an emphasis on Scientific, Technical, Engineering and Mathematics education) and research and development (R&D) policies were oriented to these goals along with increased domestic manufacturing content and the establishment of joint ventures by companies seeking access to the Chinese domestic market. In subsequent years a succession of related announcements were made, adding two new industries (digital media and aerospace). SEI goals were reaffirmed in the draft outline of the 14th Five-Year Plan (2021-2025) for national economic and social development with long-range objectives through the year 2035 (National Development and Reform Commission 2021).

Commencing earlier and accelerating after 2015 Government Guidance Funds [政府引导基金 – zhèngfǔ yǐndǎo jījīn] were deployed, normally to acquire noncontrolling equity stakes so as to guide venture capital investment into strategically-important industries. By early 2020 ¥4.76 trillion ($672 billion) had been raised. In 2015 the PBOC injected ¥48 billion into the state-owned China Development Bank. Also in 2015 the State Council announced the Made in China 2025 strategy (国务院关于印发《中国制造2025》的通知 – guówùyuàn guānyú yìnfā 《 zhōngguó zhìzào 2025 》 de tōngzhī) to develop and consolidate China’s manufacturing industries and make them internationally significant and capable of influencing international standards and supply chains. In the same year an Internet Plus Action Plan was announced to integrate mobile internet, cloud computing, big data and the Internet of Things with modern manufacturing, encourage e-commerce, industrial networks, and internet banking, and help increase the international presence of Chinese internet companies. In 2017 China’s Ministry of Industry and Information Technology published a Three-Year Action Plan for Promoting Development of a New Generation Artificial Intelligence (AI) Industry (2018–2020) designed to establish China as a world leader in the age of AI. In 2017 a Military-Civil Fusion Development Committee (MCFDC) was established to oversee a national Military-Civil Fusion strategy dating from around 2014 (although similar programmes and associated industrial zones date from the establishment of the new China). Other initiatives included the issuing by the State Council of the 2014 Guideline for the Development and Promotion of the National Integrated Circuits Industry (国家集成电路产业发展推进纲要 – guójiā jíchéngdiànlù chǎnyè fāzhǎn tuījìn gāngyào) and the establishment of two Big Funds in 2014 and 2019, respectively, to reduce reliance on imported semiconductors and counter attempt to cut off supplies. Yet other measures related to the resilience and stability of global industrial and supply chains, new information and communications infrastructure (including 5G networks, satellite communications, sensors and smart grids), new urbanisation, agricultural modernisation and rural revitalisation, with the intention of creating a modernised economy with Chinese characteristics.

Within one decade Chinese companies did emerge as a major players in a wide range of cutting-edge technologies such as green energy, 5G telecommunication, artificial intelligence, drones, and high-speed trains. But the country quickly came to face major new challenges that increased the importance of plans to accelerate their development and significantly increase self-reliance.

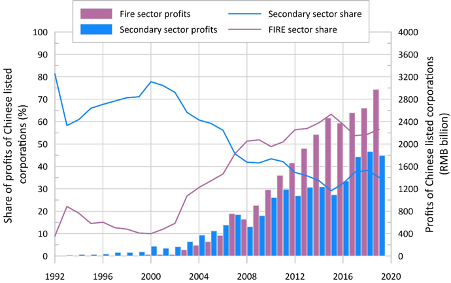

Figure 7 Magnitude and share of profits for Chinese listed corporations in secondary and FIRE sectors, 1992–2019 Source: estimated from Xie et al (2022:

The secondary sector’s share of corporate profits declined from 2000 until 2015, and, after 2012, they stagnated until 2017 (Figure 6) and the pace of accumulation decelerated (Figure 3). The share of corporate profits of finance, insurance and real estate increased, with the share of the latter overtaking that of the secondary sector in 2007, while after 2012 financial asset market speculation, that was already underway, increased. Corporate, government and household debt all increased significantly as shares of GDP (National Institute for Finance and Development and Centre for National Balance Sheets 2023). In contrast to many developing countries and the US, however, China’s external debt is low. Indeed, China is an international creditor.

In a world awash with liquidity as a result of China’s fiscal stimulus, Quantitative Easing (QE) on the part of developed country central banks, and increases in China’s domestic money supply arising from its trade surpluses (Global University for Sustainability 2015) the Chinese government had adopted (was required in some cases under the terms of WTO entry to adopt) some measures relaxing capital controls and permitting some overseas financial capital to enter Chinese markets. Combined with changes in the attractiveness of different investments, money flowed into real estate (in first and second-tier cities) and equity markets (脱事向虚 – tuō shì xiàng xū – get out of material things and into emptiness), sharply increasing prices. In 2015 the stock market crashed. In early 2016 the PBOC had to intervene to prevent shorting of the RMB, and China’s reserves dropped by almost US$1 trillion (Figure 5). In the same years OFDI served as a instrument of capital flight, requiring tighter regulation (Dunford and Liu 2023). In 2020 the government adopted a series of strong measures to control the ‘disorderly expansion of capital’ (Dunford 2022).

A second challenge relates to changes in the global order. In 1999 China embarked on ‘going out’ with OFDI increasing until 2016 when it momentarily exceeded IFDI. In the new millennium China emerged as a net provider of aid and one of the world’s largest suppliers of bilateral and multilateral development finance, as well as the initiator of important international development initiatives, starting with the creation of the Shanghai Cooperation Organisation in 2001, the BRICS dating from 2006 and the Belt and Road Initiative founded on the Five Principles of Peaceful Coexistence and the colonial and semi-colonial experience of China itself and the Global South in 2013 (Weidong Liu and Dunford 2016). In 2013 two new multilateral development banks (Asian Infrastructure Investment Bank and the New Development Bank) were established, and China quickly emerged as an actor with a vision of a new multipolar world order: a Community of Common Destiny for Humankind (人类命运共同体 – rénlèi mìngyùn gòngtóngtǐ), a Global (indivisible) Security Initiative, a Global Development Initiative and a Global Civilisation Initiative, while defending the United Nations system and international law.

In the new millennium China’s economic and demographic size, development of cutting-edge technologies, role in setting and spreading standards, construction of infrastructure and trade and investment corridors, effective governance, use of currencies other than the US dollar, engagement in global integration projects and in international diplomacy were increasingly perceived as a challenge to US political, military and economic leadership (Diesen 2021: , p. 19) and to the preservation of a US-centred unipolar ‘rules-based order’.

As a result, on the economic front China confronted increased developed county trade protectionism: alongside traditional anti-dumping and countervailing measures, and increased requirements in terms of technical, green, and labour standards, it confronted export (duties and quotas) and technology restrictions. On the security front from the US 2011 Pivot to the Pacific it was confronted with a US and developed country strategy to surround and contain it.

Addressing these challenges involves actions on several fronts. On the international stage it involves pressing ahead with a new security and globalisation path that may involve, in the short-term, a new division of the world and the development of new systems of international payments settlement. On the domestic stage it involves the restoration of productive (real) accumulation by adjusting China’s growth model and its domestic mode of production. On the one side this adjustment entails addressing the structure of domestic demand including an increase in the role of the domestic market and dealing with the adverse consequences of an excessive degree of inequality (via primary, secondary and tertiary distribution channels). A gradual expansion of domestic demand was envisaged as early as 2005 in the 11th Five-Year Plan (2006–2010), while since 2020 China has spoken of dual circulation (双循环 – shuāng xúnhuán) in which ‘domestic and overseas markets reinforce each other, with the domestic market as the mainstay’. On the supply side adjustment requires the adaptation of productive capacity so that real incomes grow and capacity is absorbed by the structure of demand. And it involves containing speculative financial activities, especially those driven by volatile foreign capital.

In the face of these challenges China is at present starting to map out an ambitious new development path that is directed at improving the quality of the lives of all Chinese people and that differs from the paths of developed capitalist countries: involved are high-quality development, scientific and technological innovation, sustainable green development, spiritual civilisation, strategic security and stability, and common prosperity. And at the same time it is seeking to contribute to the emergence of a new world order without a global Leviathan.

4 Conclusions

The new China that emerged from a semi-colonial state and civil war in 1949 was one of the poorest countries in the world. As of today, it is an upper-middle income country that has lifted all of its 1.4 billion people out of extreme poverty. In terms of material production, it is the largest economy in the world, and as a global actor it envisages a new international order centred on the equality and sovereignty of all nations and their right to choose their own development paths.

China’s own progress is a result of a socialist model that is people- rather than capital-centred and in which politics (what is called Chinese all process democracy)[v] rather than capital rules, its ability to preserve its sovereignty in an unjust and unequal world, its capacity to mobilise effectively the energy of its people and its ability to maintain high rates of investment that drove catch-up industrialisation, urbanisation and rural-urban co-evolution.

This path was profoundly shaped by changes in the international order (combined development): US sanctions and threats until the early 1970s and a renewal of US attempts to contain its rise in the new millennium, changes from assistance to conflict in its relations with the Soviet Union and more recently increasingly close relationships with the Russian Federation, effective and managed exploitation of the opportunities afforded by neo-liberal globalisation, and a record of South-South co-operation leading to a wave international development and diplomatic initiatives especially in the last decade. China’s aim was aways openness to the world, but experience has made it place considerable emphasis on self-reliance especially in the early years of the new China and in the recent past.

In part as a result of these changes in the international context, but also as a result of the internal contradictions, that emerged in each of a series of phases of development, and of the ten crises it has confronted to-date (Wen 2013, 2020) China has engaged in successive waves of reform (modes of regulation), so as to maintain an overall movement forward. China emerged from the turbulent Mao era with a core sovereign socialist industrial system, a doubling of life expectancy, an immense young, healthy and educated population and a high degree of equity. After relations with the US improved, China embarked on reform and opening-up under the leadership of Deng Xiaoping to accelerate the development of the productive forces and allowed some people and places to get rich first, in the expectation that others would get rich later. Although almost everyone’s livelihood improved overall (though not at certain times and in certain places), a dramatic growth in inequality and serious environmental and social problems and a need to innovate and reduce reliance on low-wage and low-skilled industries caused China to address more strongly the goal of common prosperity. In 2013-20 it completed successfully an extraordinary campaign to end extreme poverty. At the same time modernisation goals involve a commitment to slower and higher quality development and scientific, technological and industrial upgrading. In the new era, however, China is also seeking to identify a distinctive Chinese path to modernisation that is innovative, ecological, spiritually-rich, equitable and enriches the lives of all of its people.

At the start of the new millennium China started to ‘go out’ emerging as an important international actor, yet it quickly encountered resistance from the US and its allies. In a 1972 discussion of China’s relationship with the world, Mao (1972 [2020]: updated three stratagems recommended by Zhu Sheng to the first Ming Emperor in the late Yuan Dynasty: ‘dig deep caves, store grain everywhere and never seek hegemony.’ Mao drew on a traditional distinction between a king who rules by benevolence and righteousness (wáng quánlì – 王权力) and a hegemon who rules by power (bàquán- 霸权). Just as Mao said China should never seek hegemony (bù chēng bà – 不称霸), so repeatedly does Xi Jinping say it never will, although Mao did not preclude benevolent or virtuous rule (wáng dào tiān xià – 王道天下) (D. Zhu, 2011, p. 114). These principles are embodied in an afore-mentioned series of recent Chinese initiatives designed to contribute to the emergence of a multipolar world more conducive to the development and catch-up of the rest of the Global South.

Source: Friends of Socialist China, October 23, 2023. https://socialistchina.org/2023/10/23/chinas-development-path-1949-2022/

Originally published in the journal Global Discourse.

Author: Michael Dunford is Emeritus Professor at Sussex University in the UK and a Visiting Professor at the Chinese Academy of Sciences He is also a member of the Friends of Socialist China Advisory Group.

References Cited

Aglietta, M. (1976) Régulation et crises du capitalisme (Regulation and crises of capitalism], Paris: Calman-Lévy.