The China-proposed Belt and Road Initiative (BRI) has made steady progress in Latin America during the past three years, which has brought concrete benefits to partner economies with its people centered approach.

The growing influence of BRI in Latin America, while the US-led counterweight initiative Growth in the Americas achieved little, showed cooperation and inclusiveness have outmatched confrontation and divisiveness in the region.

Global Times on June 08, 2022 reported that the US is planning to unveil a new plan called “Americas Partnership for Economic Prosperity“, something of an upgrade of the Trump-era Growth in the Americas initiative, which experts said imitates the BRI to vie for influence, at the recent Summit of the Americas on June 6-10 in Los Angeles, USA.

However, the US decision to exclude Cuba, Venezuela and Nicaragua from the summit drew criticism, and Mexico’s president decided to skip the event.

Analysts said although the Growth in the Americas plan aims to promote private-sector investment in energy and infrastructure projects, the US lacks the necessary economic complementarity and has limited financing resources. The result: Growth in the Americas has failed to produce any tangible results in the past three years. Consequently, initial enthusiasm from Latin American countries has faded.

Despite the COVID-19 pandemic that weighed heavily on the global economy, the BRI still made concrete progress since 2020, with cooperation with Latin American countries to fight the coronavirus being an important feature.

The $1.52 billion Fourth Bridge over the Panama Canal and the $5 billion Bogota Metro Line 1 project in Colombia, two flagship projects of China Communications Construction Co (CCCC), a Chinese infrastructure giant known for building many BRI landmarks around the world, proceeded well despite the pandemic.

CCCC said in a statement sent to the Global Times on Wednesday that after decades of efforts in the South American market, the company’s SDC dredging service has expanded to Brazil, Argentina, Uruguay and Panama and provided local customers with a low-cost alternative in a market previously dominated by European firms.

The company’s dredging service for the Port of Paranagua, Brazil’s second-largest port, ensured the port was a bright spot for exports in 2021, the company said.

China Railway Construction Corp (CRCC) said that it is working on several major projects in Latin American countries.

In May, CRCC signed a construction contract for a new Demerara River Bridge in Guyana’s capital Georgetown, increasing river traffic efficiency by 75 percent and road traffic by 100 percent.

The company is also working on a 195-kilometer section of Chile’s No.5 Highway, which is to be Chile’s first highway equipped with a fully automated toll system and one of the largest infrastructure projects in the country, as well as the Arima General Hospital, one of the largest and most advanced hospitals in Trinidad and Tobago.

These large projects undertaken by large Chinese state-owned companies are accompanied by a long list of Chinese private companies investing in Latin America.

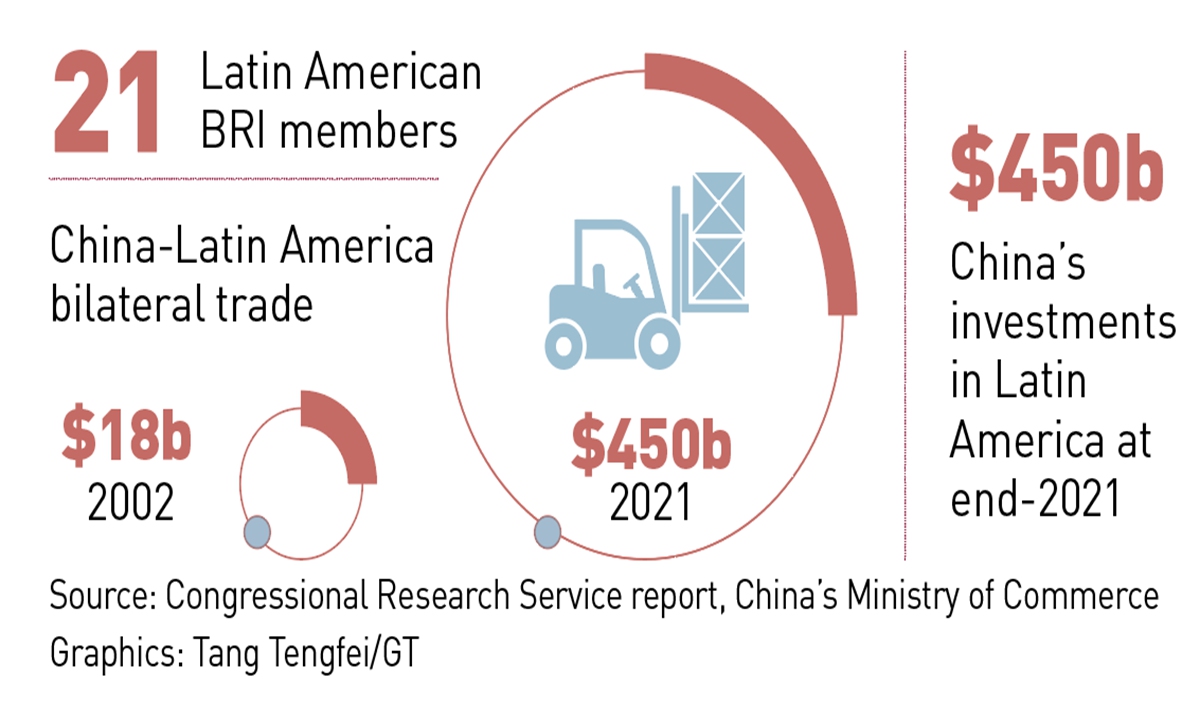

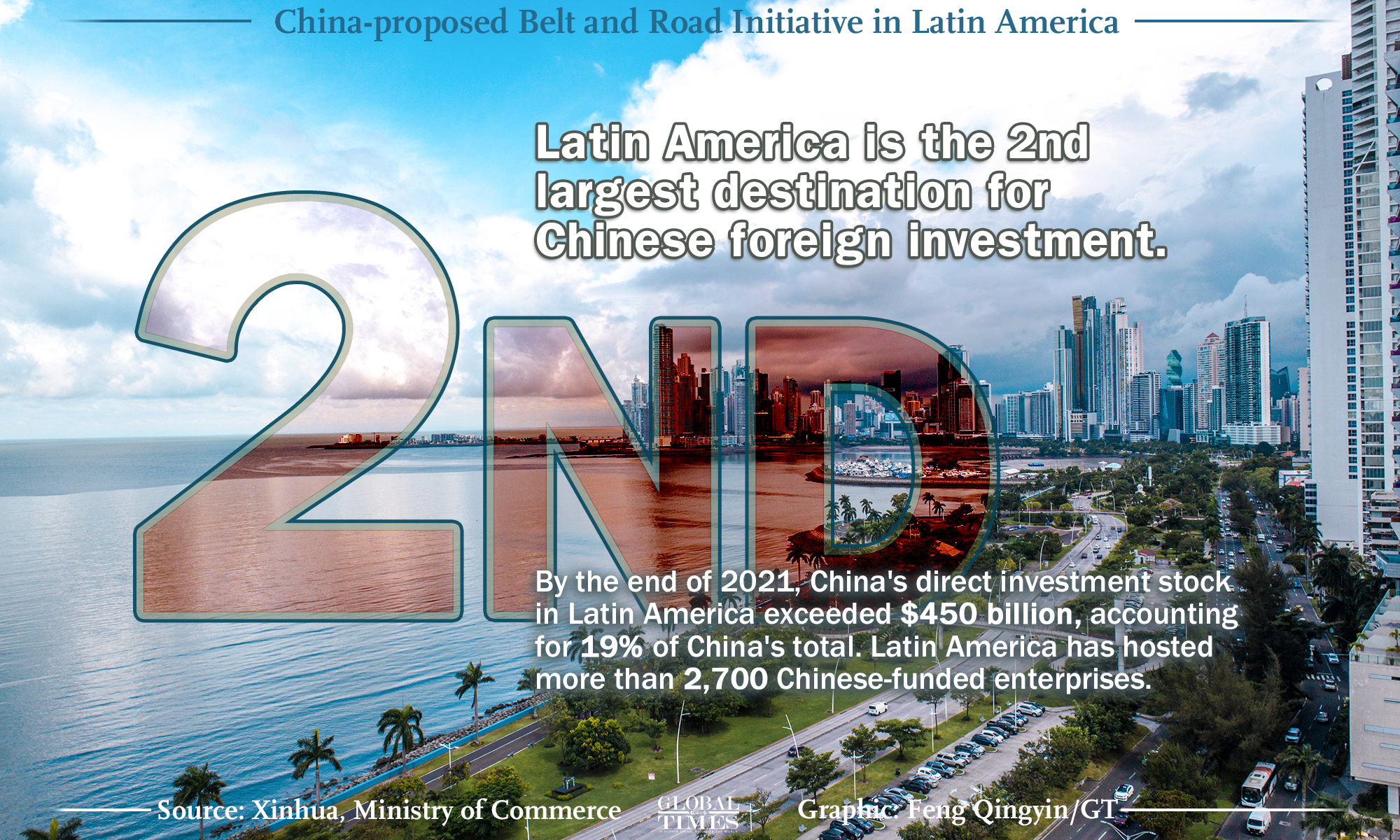

Chinese investment in Latin America, which is China’s second-largest overseas investment destination, stood at $450 billion as of end-2021 and accounted for 19 percent of total Chinese overseas direct investment, data from China’s Ministry of Commerce showed.

In 2022, the influence of the BRI in Latin America has seen a sharp increase, with Nicaragua entering into an official document on BRI cooperation in January, followed by Argentina in February.

Song Junying, director of the Latin America and Caribbean Department at China Institute of International Studies, said engaging in massive infrastructure projects has never been the US’ specialty, and the US government also lacks the financial power to make such things happen.

Analysts said the US having its own economic plan to cooperate with regional countries and some benign competition may help improve the quality of BRI projects, but if the US tries to stigmatize the BRI and attempts to force countries to choose sides, it is doomed to hit the wall as countries are fed up with attempts to politicize economic matters and to stir up ideological confrontations.

“The political climate between China and Latin American countries as well as highly complementary economic structures means that Latin American countries won’t choose sides or join some exclusive clubs the US sets up to single out China,” Song said.

In 2021, trade between China and Latin American countries exceeded $450 billion, reaching a new high and growing 40 percent from 2020.

Song said in the post-pandemic world, Latin American countries have a stronger resolve to determine their own development paths, no matter whether the US sees Latin America as its “backyard” or “front-yard.”

Song said while a growing BRI focus is on projects that are small and beautiful, large infrastructure projects remain China’s calling card, something which other players cannot provide.

Source: Global Times, June 08, 2022. https://www.globaltimes.cn/page/202206/1267619.shtml

Graphics by Feng Qingyin/GT