China Wants Its Massive EV Fleet to Plug In and Charge the Power Grid.

In a bid to strengthen the seamless integration of electric vehicles (EVs) into its power grid, China’s National Development and Reform Commission (NDRC) has introduced a set of new regulations. The move comes as the popularity of EVs continues to rise, posing challenges to power grids when numerous users simultaneously charge their vehicles.

The commission’s recent statement emphasizes the urgency of establishing the first set of technical standards governing the integration of new EVs into the national grid by the year 2025. Governments and stakeholders globally are actively seeking effective solutions to prevent potential overload on power grids.

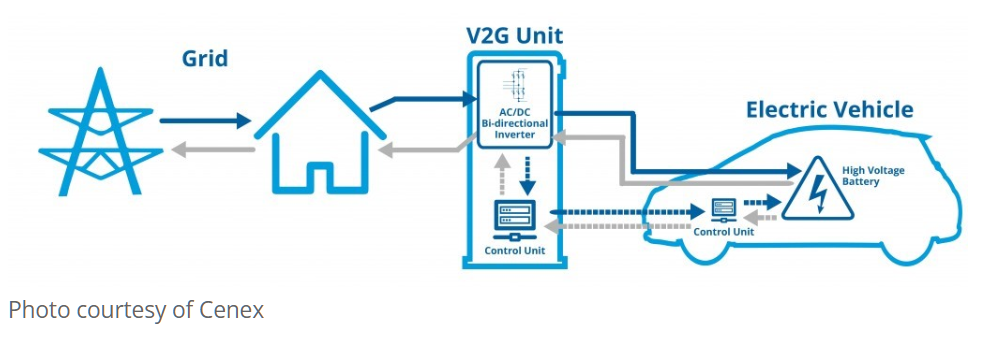

V2G – ‘vehicle-to-grid’ charging

Two noteworthy strategies highlighted in the NDRC statement include encouraging EV owners to charge during non-peak hours and exploring the concept of ‘vehicle-to-grid’ charging. The latter allows electric vehicle owners to sell excess power generated by their vehicle batteries back to the grid during peak demand periods.

Around the world there are over 50 vehicle-to-grid, or V2G, projects by the electric vehicle (EV) charging industry trying to figure out how to make it work for all participants – EV owners, utilities, auto OEMs and EV charging developers.

V2G technology involves communication between EV chargers and the power grid to delay charging and/or dispatch stored electricity back to the grid, providing demand response and frequency regulation services. This effectively turns EV batteries into an energy storage resource.

While these strategies hold promise, analysts caution that ‘vehicle-to-grid’ technology and related business ventures are still in their nascent stages. Despite this, China aims to implement over 50 pilot programs by 2025, particularly in regions with relatively mature conditions for vehicle-grid integration. These regions include the Yangtze River Delta, Pearl River Delta, Beijing, Sichuan, and Chongqing.

China’s proactive approach underscores its commitment to efficiently managing the surging power demand resulting from the growing EV market, demonstrating the nation’s leadership in sustainable energy solutions.

In a recent trial reported by CCTV, instead of charging up after plugging in, 50 EVs did it the other way around. For 30 minutes, the cars combined to feed around 2 megawatts of electricity into the grid, enough to fully power 133 houses for a day, according to a report from CCTV.

As the global frontrunner in plug-in electric vehicle (PEV) adoption, China can expect increasing impacts on its electrical grid as the uptake in PEVs and fast charging infrastructure continues to accelerate.

A earlier 2020 study employing the WRI China’s EV-Grid Simulator analyzed the impact of increased EV uptake and different charging strategies on the electrical grid in Beijing and Suzhou, both on the transmission level and the distribution level. The analysis’ Business-as-usual (BAU) and High-impact scenarios estimate increases in peak load depending on PEV uptake and charging behaviors (such as charging powers and frequencies).

Through Monte Carlo Simulation and Linear Programming, the analysis determines whether negative impacts to the grid can be minimized through Vehicle-Grid Integration (VGI) measures, such as managed charging and vehicle-to-grid (V2G). Results demonstrate that VGI measures could successfully mitigate peak load increases and potential defer costly grid capacity expansions.

EV-Grid Simulator analysis – Key findings

- At the city level in the business as usual (BAU) scenario, PEV stock is within 4.5 million by 2050, and most PEVs rely on slow charging. This results in a peak load increase of 1-5%, within existing infrastructure capabilities.

- At the city level in the High-impact scenario, PEV stock is over 4.5 million by 2050, and most PEVs utilize fast charging. Peak loads would increase by nearly 12%, possibly overwhelming the existing generation and transmission infrastructure.

- At the distribution scale, the electrification of 50% of private vehicles will result in transformer overload.

- V2G is most effective at shaving local peak loads, while controlled charging is ideal to optimize PEV’s charging loads.

- A time-of-use (TOU) tariff may reduce peak loads, but its impact is limited as it may shift demand to the beginning of the off-peak period and create another load spike.

- Despite V2G being the most effective strategy, its technical, regulatory, and public acceptance barriers will inhibit its widespread use in the near-term.

- Controlled charging is seen as the most viable approach in the near-term to mitigate the negative impacts of PEV uptake on the electrical grid.

Sources:

- Caixin Global, Jan 09, 2024. https://www.caixinglobal.com/2024-01-09/china-wants-its-massive-ev-fleet-to-plug-in-and-charge-the-power-grid-102154603.html

- World Resources Institute, Jan 1, 2020. https://files.wri.org/d8/s3fs-public/2022-02/quantifying-grid-impacts-large-adoption-electric-vehicles-china.pdf?VersionId=uTaNtsYBiAjWu7Ri2M887scAS9E66Vl.