Green technological progress is crucial for environmental protection and economic growth in China. Over the past decades, China has made huge progress in this arena which exerts far-reaching consequences for its economic and social development.

In a distinct move away from high-speed growth and economic volume, China’s leadership is intent on enhancing the quality and ecological sustainability of economic development and improving the well-being of the people.

China is moving towards the cutting edge of new technologies, and in certain areas, such as the ownership and supply of critical materials and renewable energy manufacture, it is already leading the world.

Since the United States began its crusade against the Chinese semiconductor industry, it has steadily increased sanctions and tariffs on Chinese companies, even sanctioning or forcing non-Chinese companies, such as the Dutch ASML, to stop selling lithographic equipment to China.

THE CASE OF HUAWEI

One of the hardest-hit companies has been Huawei. In 2020, it was forced to sell one of its main smartphone brands because of a lack of chips. More than a dozen developed countries excluded it from 5G contracts, its revenue fell 30% in 2021, and net profits plummeted 70% in 2022. In May this year, US regulators revoked a permit allowing Intel and Qualcomm, two US technology groups, to sell Huawei chips.

However, as The Economist reported, the Western sanctions created an opposite effect than intended. In this adverse context, Huawei began to replace the foreign technology used in its products with parts and software produced domestically, thereby increasing its resilience to Western sanctions, increasing its sales, and returning to the cell phone market.

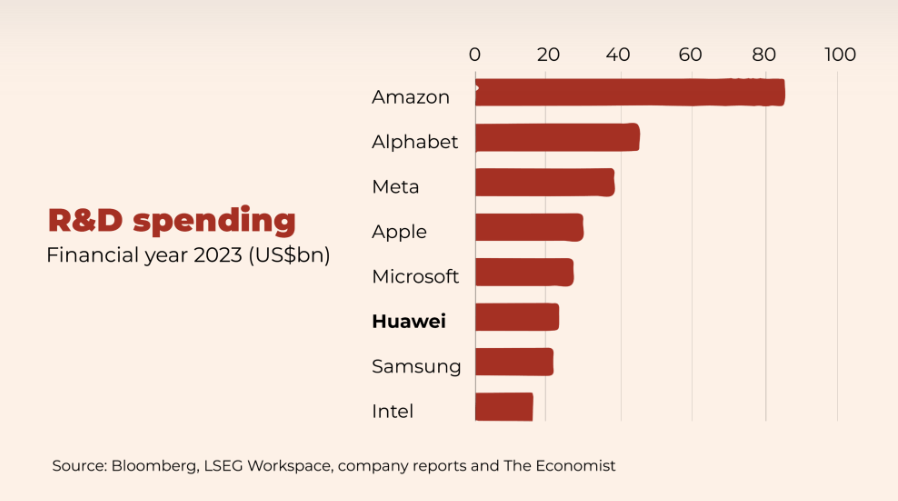

Some 114,000 of the company’s employees, more than half of the total, work in research and development. The company has replaced 13,000 foreign-made parts with Chinese ones. While US sanctions have prevented Huawei from investing in other areas, they have also stimulated rapid development of Huawei’s intellectual property and pushed it to diversify into new lines of business.

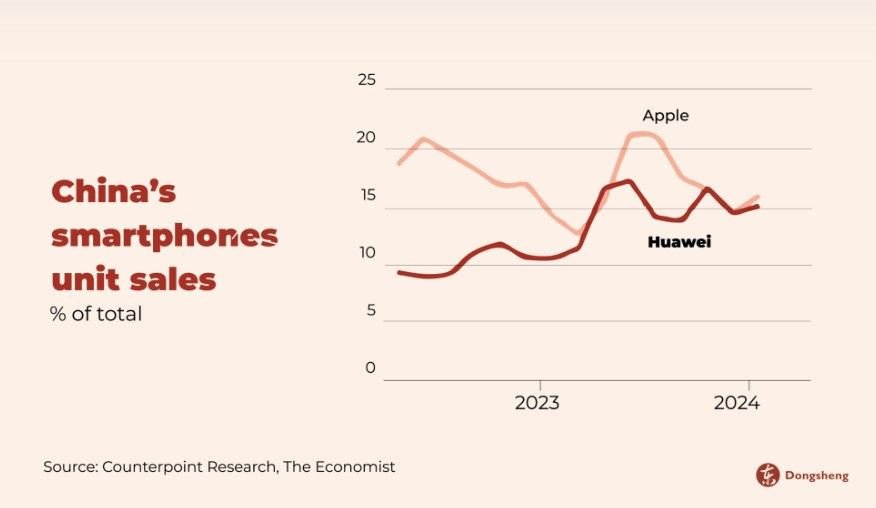

About 70% of the components (by value) of the Huawei Mate60 Pro+, a smartphone launched in September, are made in China. Now, Huawei went from having 9% of the smartphone market share in the first three months of 2023 to 15.5% in the same period of 2024.

Huawei also manufactures watches, televisions, and control systems for Chinese electric cars. In the first quarter of this year, net profits rose 564% year-on-year to 19.7 billion yuan (US$2.7 billion ). Revenue from consumer devices grew by around 17% in 2023, thanks mainly to its new smartphones.

The growth and transformation of China’s economy are subtle but powerful. China’s economic transition isn’t going away and will become ever-more relevant to international business, politics and the global economy itself, well into the 21st century.

Sources:

- Dongsheng News on China, June 30, 2024. https://dongshengnews.org/en/news-on-china-no-184-en/

- CGTN, June 27, 2024. https://news.cgtn.com/…/How-China-s-shifting…/p.html