With the global demand for Electric Vehicle (EV) batteries projected to jump up to tenfold by 2030, Chinese firms have been unveiling new lithium-ion cells with longer ranges, shorter charging times and more charging cycles in their lifespans, at a frequency unseen anywhere else in the world.

Lithium Ferro Phosphate & Nickel Manganese Cobalt batteries

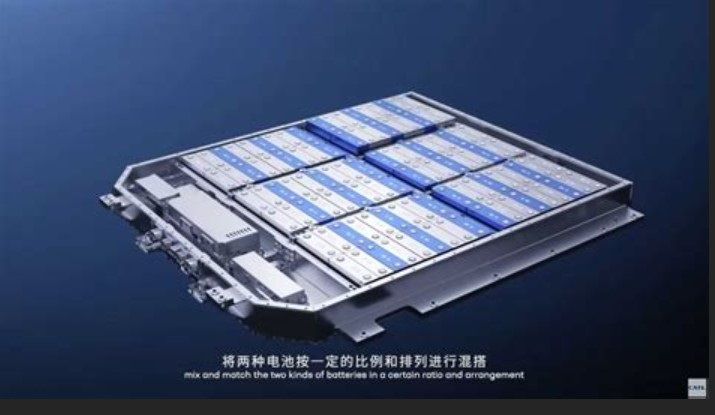

Currently, commercial EVs use one of two main types of lithium battery – those that contain iron and phosphate, known as LFPs, and those that contain nickel, manganese and cobalt, known as NMCs.

LFPs are more environmentally friendly than NMCs because cobalt and nickel are heavy metals that can be harmful to humans and the environment, particularly the aquatic environment.

The primary distinction between them is that NMCs usually have a greater energy density while LFPs are safer.

Energy density measures how much energy a battery contains in proportion to its weight, and is a key performance metric.

The two types of battery have an equal footing in the EV market globally, but in China, LFPs have become far more popular over the past few years because they are safer.

Leading Chinese manufacturers CATL and BYD batteries are LFPs – which are also cheaper to make than NMCs given the high cost of cobalt and nickel.

SEARCHING FOR NEW OPTIONS

Companies in China and other countries are pursuing alternative batteries not centred around lithium, in part because the minerals needed to make them come from just a few countries.

These elements are often described as “critical raw materials” or “transitional minerals”, and they mostly include lithium, cobalt, nickel, manganese and graphite. Their concentrated supply chains can lead to problems such as dramatic price swings.

Batteries typically make up 40% of the cost of an EV, and the ability of manufacturer’s to minimise production cost is critical for firms to survive the intense EV price wars.

In addition, a battery carries 40-60% of the embedded greenhouse gas emissions in the production of an EV.

These factors have motivated Chinese car and battery makers to look for alternative battery technologies that are not only cheap, but also suitable for mass production.

Sodium-ion batteries

Sodium-ion batteries are one of the technologies being developed. Sodium is a highly abundant element that can be extracted from sea salt.

CATL debuted its first-generation sodium-ion battery in 2021 amid rapidly risingprices. Other Chinese companies have sinceannounced plans to develop sodium-ion batteries.

Sodium-ion batteries are likely to be the first to make headway because they are close to commercialisation and can achieve similar performance to LFP cells.

Although sodium-ion batteries are cheaper and more sustainable, their main drawback currently is their lower energy density, and consequently support a shorter range in EV use than a lithium-ion battery of the same weight.

The technology is therefore more likely to be more suited to low-speed and small EVs, as well as electric trikes and scooters. Another key application is likely to be for non-transport stationary energy storage sector by providing safe, reliable and cost-effective methods to store renewable power.

Sodium-ion batteries also deal effectively with cold temperatures, and so potentially a viable option for applicationsin far-northern regions such as Scandinavia or Russia.

Solid-state batteries

Solid-state batteries are another emerging technology. These replace the liquid or gel electrolytes in traditional lithium-ion batteries with solid electrolytes. They offer higher energy densities, improved safety as they are less prone to catching fire, and potentially longer lifespans. They could also charge faster and have lower carbon footprints than the current lithium-ion options.

However their high manufacturing costs could pose a roadblock. Solid electrolytes are more difficult to design and more expensive to fabricate – factors that have restricted their mass production. The cost to produce solid-state batteries can be four to 25 times higher than conventional lithium-ion batteries. Chinese companies such as CATL and China Aviation Lithium Battery (CALB) are heavily investing in developing this technology.

Source: Dialogue Earth,June 18, 2024. [Edited extracts]

Read full article at: https://dialogue.earth/…/chinas-position-in-the-global…/