On July 18, the American solar giant SunPower announced the suspension of several core operations. The company will neither acquire new customers nor install already-delivered solar panels. A day later, Renova Energy, affected by SunPower’s shutdown, declared a temporary halt of all operations in California and Arizona.

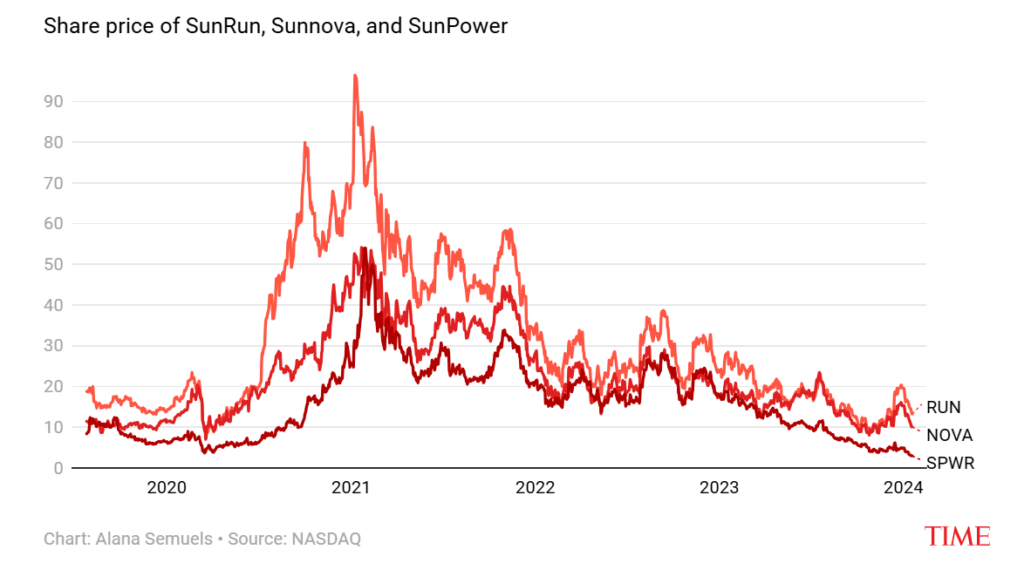

SunPower is the third major US solar company to face significant troubles within a month. Just days prior, Toledo Solar, another American solar manufacturer, announced it would cease all research and development and gradually wind down operations, signaling impending bankruptcy. On June 28, Titan SolarPower, a top-six US residential solar installer, permanently closed its doors.

Several smaller solar companies, including Infinity Energy, Solcius, and Kayo Energy, have also declared bankruptcy this year. According to Solar Insure, 16 large solar companies have gone under since 2023, with over 100 solar companies filing for bankruptcy in the year 2023 alone.

It’s noteworthy that as early as 2012, the US imposed anti-subsidy and anti-dumping investigations on Chinese solar companies, raising tariffs continuously. In May 2024, the US further increased tariffs on Chinese solar cells (whether assembled into modules or not) from 25% to 50%.

Despite restrictions on Chinese imports, the Biden administration signed the Inflation Reduction Act of 2022, allocating $369 billion over the next ten years to combat climate change and enhance energy security, including subsidies for the solar and renewable energy industries to support domestic businesses. However, the US solar sector still faces its biggest crisis to date.

The primary cause lies in the US solar companies’ heavy reliance on policy subsidies and financing, making them extremely sensitive to interest rates and policy changes. The Federal Reserve’s prolonged high interest rates and the reduction of electricity subsidies have led to weak end-user demand, leaving companies struggling. Years of over-financialization have also caused solar companies to deplete future industry demand. Additionally, the growing anti-renewable energy sentiment, fueled by figures like Donald Trump, has further chilled the sector.

1. Solar Giant Nears Bankruptcy

Founded in 1985, SunPower initially focused on solar cell production and went public on Nasdaq in 2005. French energy giant TotalEnergies held a 65% stake in SunPower, making it the majority shareholder.

In 2020, SunPower underwent significant restructuring, spinning off its cell and module manufacturing business to Maxeon Solar Technologies in Singapore. As part of this deal, TCL Zhonghuan invested $298 million to acquire a 29% stake in Maxeon. SunPower subsequently shifted its focus to distributed generation, storage, and energy services in North America.

In 2022, SunPower further divested its commercial solar division to TotalEnergies for $250 million, stating that it would concentrate more on the residential solar market. In 2023, SunPower’s solar system sales totaled 524 megawatts.

However, the company’s operations have heavily depended on policy preference rather than its own strength, leading to its current predicament.

US solar companies have often been persuading customers by financial leasing, allowing customers to acquire solar equipment with minimal or even zero down payment, covering expenses through grid-tied electricity generation revenue.

For nearly a decade, low interest rates and government subsidies for renewable energy have driven the US solar industry’s growth. However, these factors have now reversed.

Since March 2022, amid rising inflation, the Federal Reserve has raised interest rates 11 times, increasing the federal funds rate from 0%-0.25% to 5.25%-5.5%, the highest level in 22 years. This interest burden primarily falls on solar companies rather than customers, escalating financial pressure on companies like SunPower.

More crucially, the introduction of a new electricity pricing system in the US has significantly dampened customer enthusiasm for solar installations.

In 2023, California, the largest solar market in the US, implemented the NEM3.0 pricing system, reducing the compensation households and businesses receive for excess solar power fed back into the grid. This further dampened rooftop solar demand in the state. Other states are now considering similar measures.

In California, rooftop solar installations plummeted by 80% due to these policy changes. The California Solar & Storage Association (CALSSA) reported that thousands of installation projects stalled, companies’ net losses expanded, and the whole sector saw 17,000 layoffs, with several large solar companies going bankrupt.

Beyond California, the outlook remains bleak. Ohm Analytics data shows that after solar installation growth rates reached around 30% in 2021 and 2022, residential installation slowed down to below 10% in 2023. It is projected that US residential solar installations will decline by 20% in 2024.

As a result, SunPower posted a net loss of $247 million for fiscal year 2023, with new customer acquisitions declining for four consecutive quarters.

According to a report by Roth MKM, SunPower has informed dealers that starting September 17, 2024, it will no longer support new lease and power purchase sales or new installations, effectively halting all shipments and installations.

“They are essentially saying that they’re not able to continue operations,” said the BloombergNEF analyst Pol Lezcano, indicating the troubles were deepened. Roth analyst Philip Shen also wrote in a report that the company may have “hit a wall.”

SunPower has not disclosed how long the installation pause will last, and JPMorgan researchers believe the situation may not be resolved quickly.

According to Roth Capital Partners, over 100 residential solar dealers and installers declared bankruptcy in the US by the end of 2023, a figure six times higher than the previous three years combined. They predict that at least another 100 companies will go under in 2024, with SunPower’s shutdown validating this forecast.

2. Blaming China While Providing Billions in Subsidies

While a significant number of US solar companies are collapsing, some are thriving against the odds.

As China’s solar industry giants see declining numbers, the US solar company First Solar has quietly become the world’s most valuable solar company, with a market capitalization of $25.8 billion. This marks the first time since 2018 that a non-Chinese company has topped the industry. In terms of shipments, First Solar’s annual volume of 11.5 GW ranks tenth globally, far behind the top-ranked JinkoSolar’s 75 GW. What has made First Solar the industry leader in market value? The answer lies in its financial reports.

The report shows that in 2022, the company lost over $40 million but turned a profit of $831 million in 2023, with $660 million of that coming from Inflation Reduction Act (IRA) subsidies. In other words, most of its profits depend on government subsidies.

This year, the company expects to receive over $700 million in government subsidies, potentially reaching $10 billion over the next decade.

Meanwhile, the US has imposed high tariffs on Chinese solar products, causing their prices in the US market to triple the global average, allowing First Solar to secure more orders.

Besides First Solar, Suniva serves as another example of the US’s massive subsidies.

On March 27, US Treasury Secretary Janet Yellen visited a Suniva solar cell manufacturing plant in Norcross, Georgia, where she publicly criticized China’s solar, electric vehicle, and lithium battery industries, claiming their capacity expansions constituted unfair competition, “distorting global prices” and “harming American businesses and workers.”

However, according to the US Treasury, Suniva was forced to close in 2017, largely due to the influx of affordable Chinese solar products. Thanks to the IRA, a batch of US green energy manufacturers received tax credit incentives, reviving companies like Suniva.

3. Over-Financialization and Legal Battles in the Solar Industry

To secure more government subsidies, solar companies need higher shipment volumes, leading sales teams to employ aggressive tactics, often trapping end-users in financial pitfalls.

According to Time, in 2022, 83-year-old Mary Ann Jones was approached by a solar salesman claiming to offer a government utility plan providing free solar panels. He instructed her to touch a tablet to finalize the deal.

Later that year, Jones received a call from fintech company GoodLeap, revealing she had unwittingly taken out a $52,564.28 loan for solar panels, with the loan due when she turned 106. The loan amount exceeded the down payment on her California home, and her $960 monthly income was insufficient to cover the massive debt.

Jones’s attorney, Kristin Kemnitzer, stated that her company receives several calls weekly from potential clients with similar stories.

Solar customers across the US report that salespeople often obscure the financial details of agreements and the actual value of the products they are selling. Legal disputes in the solar industry are piling up. “I’ve been working in consumer law for over a decade, and I’ve never seen anything like what’s happening in the solar industry,” Kemnitzer said.

Since 2016, large solar companies have relied on Wall Street financing to fuel their growth. This financialization has driven up consumer costs for solar panels and encouraged companies to aggressively pursue sales to maximize the benefits of low interest rates and increase their cash flows. To sell more panels, salespeople often paint overly optimistic pictures, convincing customers to install solar systems.

Energy Sense Finance founder Jamie Johnson, who has studied the residential solar industry for a decade, often hears people compare solar financing and sales to the “Wild West” due to the creativity involved. He says this reflects the Silicon Valley mindset of “disrupt first, let regulators catch up later.”

The excessive financialization of the US solar industry has led to a surge in legal disputes. Jesus Hernandez, a 53-year-old homeowner, recounted how a salesperson from Southern Solar contacted him in 2019, promising that installing solar panels would reduce his monthly electricity bill from $500 to $50. Hernandez, who couldn’t afford the upfront costs, was told that GoodLeap would provide him with a loan. The salesperson even assured him that the government would issue a $16,000 solar rebate check if he installed the panels. Convinced, Hernandez agreed to take out a 20-year loan to install solar panels valued at approximately $62,000.

However, after adding interest and fees, the $62,000 loan ballooned to $90,000. Now, Hernandez is burdened with monthly loan repayments of around $400, while his electricity bill remains at $500 because the solar panels have not delivered the promised energy savings.

4. The US Solar Industry Faces a Reshuffle

The US solar industry experienced rapid growth, driven by massive subsidies and a previously favorable financial environment. However, such a business model heavily reliant on subsidies is not sustainable, and policy shifts have begun to expose the industry’s vulnerabilities.

With the new US tariff regulations on Chinese products, the world’s most comprehensive and cost-effective solar products are rejected by the American market. This has led to soaring manufacturing costs, placing further strain on the US residential solar market.

Zhang Sen, Secretary-General of the Solar Photovoltaic Products Division of the China Chamber of Commerce for Import and Export of Machinery and Electronic Products, noted that the closed market has significantly driven up US solar installation prices to three to four times higher than in other countries. This has exacerbated inflationary pressures on solar installations, weakened demand, and led to a wave of bankruptcies in the industry. Consequently, this has also hindered the widespread adoption and development of the US solar and renewable energy industries.

It is also important to note that the recent favorable outlook for Donald Trump’s campaign, known for his opposition to renewable energy, has raised concerns within the solar industry. Despite the substantial subsidies currently in place, the US solar industry is still facing numerous bankruptcies. If policy subsidies were to be removed, even with high tariffs on superior Chinese products, it remains uncertain whether US solar companies could withstand the market pressures.

Source: China Academy, https://thechinaacademy.org/surge-in-u-s-solar-company-bankruptcies-despite-trillions-in-subsidies/